Page 35 - Annual Report 2017

P. 35

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

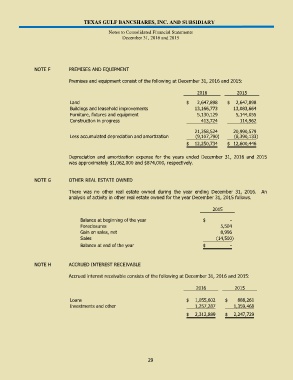

NOTE F PREMISES AND EQUIPMENT

Premises and equipment consist of the following at December 31, 2016 and 2015:

2016 2015

Land $ 2,647,898 $ 2,647,898

Buildings and leasehold improvements 13,166,773 13,083,664

Furniture, fixtures and equipment 5,130,129 5,144,055

Construction in progress 413,724 114,962

21,358,524 20,990,579

Less accumulated depreciation and amortization (9,107,790) (8,390,133)

$ 12,250,734 $ 12,600,446

Depreciation and amortization expense for the years ended December 31, 2016 and 2015

was approximately $1,062,000 and $874,000, respectively.

NOTE G OTHER REAL ESTATE OWNED

There was no other real estate owned during the year ending December 31, 2016. An

analysis of activity in other real estate owned for the year December 31, 2015 follows.

2015

Balance at beginning of the year $ -

Foreclosures 5,504

Gain on sales, net 8,996

Sales (14,500)

Balance at end of the year $ -

NOTE H ACCRUED INTEREST RECEIVABLE

Accrued interest receivable consists of the following at December 31, 2016 and 2015:

2016 2015

Loans $ 1,055,602 $ 888,261

Investments and other 1,257,287 1,359,468

$ 2,312,889 $ 2,247,729

29