Page 31 - Annual Report 2017

P. 31

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

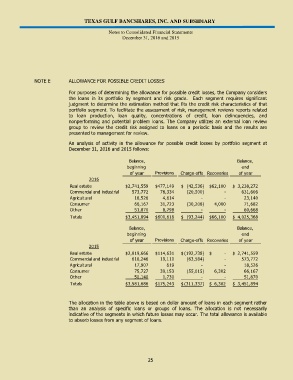

NOTE E ALLOWANCE FOR POSSIBLE CREDIT LOSSES

For purposes of determining the allowance for possible credit losses, the Company considers

the loans in its portfolio by segment and risk grade. Each segment requires significant

judgment to determine the estimation method that fits the credit risk characteristics of that

portfolio segment. To facilitate the assessment of risk, management reviews reports related

to loan production, loan quality, concentrations of credit, loan delinquencies, and

nonperforming and potential problem loans. The Company utilizes an external loan review

group to review the credit risk assigned to loans on a periodic basis and the results are

presented to management for review.

An analysis of activity in the allowance for possible credit losses by portfolio segment at

December 31, 2016 and 2015 follows:

Balance, Balance,

beginning end

of year Provisions Charge-offs Recoveries of year

2016

Real estate $ 2,741,559 $ 477,149 $ (42,536) $ 62,100 $ 3,238,272

Commercial and industrial 573,772 78,334 (20,500) - 631,606

Agricultural 18,526 4,614 - - 23,140

Consumer 66,167 31,723 (30,208) 4,000 71,682

Other 51,870 8,798 - - 60,668

Totals $ 3,451,894 $ 600,618 $ (93,244) $ 66,100 $ 4,025,368

Balance, Balance,

beginning end

of year Provisions Charge-offs Recoveries of year

2015

Real estate $ 2,819,666 $ 114,631 $ (192,738) $ - $ 2,741,559

Commercial and industrial 618,246 19,110 (63,584) - 573,772

Agricultural 17,907 619 - - 18,526

Consumer 75,727 39,153 (55,015) 6,302 66,167

Other 50,140 1,730 - - 51,870

Totals $ 3,581,686 $ 175,243 $ (311,337) $ 6,302 $ 3,451,894

The allocation in the table above is based on dollar amount of loans in each segment rather

than an analysis of specific loans or groups of loans. The allocation is not necessarily

indicative of the segments in which future losses may occur. The total allowance is available

to absorb losses from any segment of loans.

25