Page 412 - Aida Hovsepian Onboarding

P. 412

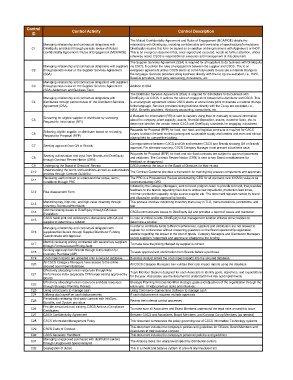

Control Control Activity Control Description

ID

The Mutual Confidentiality Agreement and Rules of Engagement (MCA/ROE) details the

Managing relationship and contractual obligations with relationship with DineEquity, including confidentiality and ownership of specifications/formulations.

C1 DineEquity and Brand through periodic review of Mutual DineEquity requires this form be signed as a condition of doing business with Applebee’s or IHOP.

Confidentiality Agreement / Rules of Engagement (MCA/ROE) This is an evergreen document that, once signed and executed, needs no further attention, unless

otherwise noted. CSCS is responsible for execution and management of this document.

The Supplier Services Agreement (SSA) is required for all suppliers to do business with DineEquity

Managing relationship and contractual obligations with suppliers via CSCS. It outlines the rules of engagement between the supplier and CSCS. This is an

C2 through period review of the Supplier Services Agreement evergreen agreement unless CSCS elects at some future point to execute a material change to

(SSA) the language. Services providers doing business directly with the Co-op are excluded; i.e., HAVI,

Benefits providers, third party accounting, consultants, etc.

Managing relationship and contractual obligations with suppliers

C3 through period review of the Supplier Services Agreement Addition to SSA

(SSA) Addendum and Business Term

The Distributor Services Agreement (DSA) is required for distributors to do business with

Managing relationship and contractual obligations with DineEquity via CSCS. It outlines the rules of engagement between the distributor and CSCS. This

C4 distributors through period review of the Distributor Services is an evergreen agreement unless CSCS elects at some future point to execute a material change

Agreement (DSA) to the language. Services providers doing business directly with the Co-op are excluded; i.e.,

HAVI, Benefits providers, third party accounting, consultants, etc.

A Request for Information (RFI) is sent to vendors using Havi or manually to secure information

Screening for eligible supplier or distributor by reviewing

C5 about the company, plant capacity, assets, financial disposition, assets, customer base, etc. to

Request for Information (RFI)

determine whether the vendor meets CSCS and DineEquity standards for engaging in business.

Requests for Proposal (RFP) for food, non-food, and logistics contracts is required for CSCS

Selecting eligible supplier or distributor based on reviewing

C6 buyers to obtain the best contract pricing and sustainable supply and creates and even and ethical

Request for Proposal (RFP)

playing field for competitive bidding.

Correspondence between CSCS and QA and between CSCS and Brands showing QA or Brands'

C7 Seeking approval from QA or Brands

approval. For alternate sourcing, CSCS Category Manager must present a business case.

Requests for Proposal (RFP) for food and non-food contracts are subject to approval processes

Seeking authorization and input from Brands and DineEquity

C8 and validation. The Contract Review Notice (CRN) is sent to key Brand constituencies for

through Contract Review Notice (CRN)

feedback or disapproval.

C9 Undergoing the Board of Directors' Review CSCS presents the issue to the Board of Directors for their review

Understanding the terms and conditions as well as authorization

C10 The Contract Guideline provides a framework for tracking key process components and approvals

process through Contract Guideline

Reviewing each contract to understand the scope, terms, The PRC is a Procurement Review conducted by CEO for all contracts over $15M in value or as

C11

conditions through PRC recommended by CPO

Initiated by the Category Managers, sent to brand program team to provide to brand, that provides

feedback to the brands regarding risks due to unique raw ingredients, production lead times,

C12 Risk Assessment Form

min/max production capacity, single source supplier etc. The document requests review by brand

and discussion and/or approval by brands.

Monitoring key, high-risk, and high-value inventory through This process involves monitoring inventory that is key in TLO, menu transitions, promotions, and

C13

Inventory Scorecard/Workbook test

Communicating issues to DineEquity through QA Issue

C14 CSCS communicates issues to DineEquity QA and provides a report of issues and resolution

Escalation

CSCS holds joint and collaborative discussions with QA and In case of critical events, DineEquity's risk management function initiates conversations to

C15

supplier to determine a solution determine a solution.

In order to contribute funds to Brand conferences, suppliers and distributors are not allowed to

Managing relationship and contractual obligation with

C16 suppliers/distributors through Supplier/Distributor Funding register for conferences without answering questions on the Brand sponsorship registration

website regarding the impact to the cost of goods. Category Managers and Distribution Managers

Questionnaire and Approval

review suppliers' responses and approve or disapprove the funding

Monthly reviewing pricing contracted with several key suppliers

C17 To make sure the pricing charged by supplier is correct

through Formula-based Pricing Audit

Seeking approval from Brands through Authorization for

C18 To seek approval and confirmation from Brands before a purchase

Inventory Purchase (AIP)

C19 Cost impact reports are uploaded onto a secured database. Business Analyst enters the cost impact reports into the secured database.

All CSCS Category Managers have access to the online

C20 All CSCS Category Managers can validate their cost impact reports using the database.

secured cost impact database.

Effectively allocating human resources through Key

C21 Performance Index (especially CPM target setting approved by Team Member Goals is designed for each Associate to identify goals, objectives, and expectations

for the year. Associates use the document to understand their key accomplishments

Board)

Effectively allocating human resources and data resources Strategic Planning Process identifies strategic goals and objectives of the organization through the

C22

through Strategic Planning Process entire year. It helps prioritize tasks and initiatives.

C23 Using a third party to manage cash Using Commerce Connections Software to manage cash

C24 Utilizing dual signoff on cash disbursements A cash disbursement requires multiple approvals

Periodically reviewing third-party controls with InfoSync,

C25 Review their internal control processes

Benefits, and System providers

Provide annual antitrust training; CSCS Antitrust Compliance

C26 To make sure all Associates and Board Members understand the legal risks around this issue

Certificates

C27 CSCS Confidentiality Agreement Between CSCS and Associates, Board Members, and Concept Co-op Members (as needed)

C28 CSCS Information Management Policy This document summarizes the policy governing use of CSCS Information Technology systems

This document includes the company's policies and guidelines for Officers, Board Members and

C29 CSCS Code of Conduct

Associates in their business conduct

C30 CSCS Associate Handbook This document includes the company's personnel policies and guidelines

Managing unapproved purchases with distribution centers

C31 The Analysis looks into unapproved spend by distribution centers

through Unapproved Spend Analysis

C32 Segregation of duties This is a check and balance system to prevent any fraudulent act.