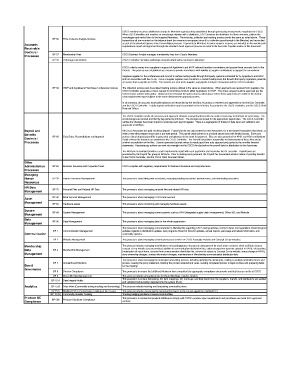

Page 410 - Aida Hovsepian Onboarding

P. 410

CSCS monitors the prices distributors charge its Members against pricing established through purchasing arrangements negotiated by CSCS.

When CSCS identifies and resolves an overcharge situation with a distributor, CSCS invoices the distributor for those amounts, collects the

overcharges and remits them to the impacted Members. The invoicing, collection and tracking process works the same as noted above. These

BP 56 Price Variance Analysis Invoices

transactions all are recorded on the balance sheet (no revenue is recognized since it’s a collection pass-through to the Member) and reconciled

Accounts as part of the standard balance sheet reconciliation process. Payments to Members for price variance recovery are included on the weekly cash

requirements report and approved through the standard check approval process as noted in the Accounts Payable section of this document.

Receivable

Controls /

Processes BP 57 Membership Fees CSCS Business Analyst manages membership fees from Coop's Members

BP 58 Patronage Calculations CSCS Controller calculates patronage amounts which will be returned to Members

CSCS collects money from suppliers in support of Applebee’s and IHOP national franchise conventions and passes these amounts back to the

Brands. This process was established as a means to provide franchisees with visibility to supplier contributions to support the conventions.

Suppliers register for the conferences and commit to certain funding levels through third-party systems contracted for by Applebee’s and IHOP

and not Associated with the Co-op. Once a supplier registers and commits to a certain funding level, the Brand’s third party organizers generate

an invoice that is payable to CSCS. The invoices are sent to the supplier, copying the InfoSync Accountant and the CSCS Controller.

BP 59 IHOP and Applebee’s Franchisee Conference Invoices The collection process and Associated tracking process utilized is the same as noted above. When payments are received from suppliers, the

CSCS Controller generates a check request to remit those funds to either Applebee’s or IHOP. The check request must be approved per the

CSCS invoice authorization policy. Disbursement is through the same process noted above where these payments are noted on the weekly

cash requirements report subject to the same disbursement approval process.

In all scenarios, all accounts receivable balances are reconciled by the InfoSync Accountant, reviewed and approved by the InfoSync Controller,

and the CSCS Controller. A daily deposit verification report is provided by the InfoSync Accountant to the CSCS Controller, and the CSCS Chief

Financial Officer.

The CSCS Controller sends all necessary and approved changes in payroll and benefits via email or hard copy to InfoSync for processing. The

email changes are printed and filed by pay period by InfoSync. The changes are keyed for the appropriate payroll date. The CSCS Controller

verifies the changes have been made by reviewing each payroll register. There is a segregation of duties for data input and validation and

approvals at InfoSync.

Payroll and All CSCS Associates are paid via direct deposit. Payroll checks are only created for new Associates, for a terminated Associate’s final check, or

Benefits BP 60 Data Entry, Reconciliations and Approval when a new direct deposit must have a pre-note period. The payroll check printer is in a locked secure area with limited access. Every pay

period a direct deposit payroll file is generated and uploaded to the bank for payment. Files are also generated for 401K and HSA contributions.

Controls / Detail of these file transfers are provided to the CSCS Controller. The Benefit Specialist is responsible for transmission of these files and to

Processes confirm reconciliation of the files. System generated journal entries for each payroll are auto captured and posted to the monthly financial

statements. Associate pay advices are sent via overnight mail to CSCS the day before the payroll date for distribution to the Associates.

The InfoSync Accountant provides a cash requirements report with each payroll run and reconciles the GL accounts. Payroll taxes are

processed by the Payroll Tax group at InfoSync. Prior to making every payment, the Payroll Tax Accountant sends a notice of pending transfer

to the CSCS Controller, and the CSCS Chief Financial Officer.

Other

Administration BP 65 Business Insurance and Corporate Taxes CSCS complies with regulatory requirements for business insurance and corporate taxes

Processes

Managing

Human BP 70 Human Resource Management This process is about hiring new associates, managing existing associates' performances, and terminating associates.

Resources

HR Data BP 75 Personal Files and Related HR Data This process is about managing personal files and related HR data

Management

Asset BP 80 Bank Account Management This process is about managing CSCS bank account

Management BP 85 Hardware assets This process is about monitoring and managing hardware assets

System BP 90 System Management This process is about managing current systems such as HAVI (integrated supply chain management), Office 365, and Website

Management

Data

Management BP 95 Data Management This process is about managing data for the whole organization

This process is about managing communication to Membership regarding CSCS pricing updates, contract status and negotiation, Brand program

BP 1 Communication Management updates, logistics & distribution updates, new programs, Board of Director updates, annual reports, patronage and rebate information, and

Communication commodity updates.

BP 2 Website Management This process is about managing content and access control on CSCS Associate website and Concept Co-op websites.

Membership This process includes managing new Member on boarding(proper documents and payment for stock share received, stock certificate issued,

Data BP 3 Membership Management concept Co-op website access provided, addition to communication distribution lists, status change/new operator updated in HAVI); off boarding

(redemption of stock share, removal from communication distribution list, removal of access to Concept Co-op website, status change in HAVI),

Management store ownership changes, contact information changes, maintenance of Membership communication distribution lists

This process is about managing the nomination and voting process, including updating the documents, mailing & sending nomination forms and

BP 4 Annual Board Elections proxies, creating the proxy statement, tracking the proxies received and votes, sending completed proxies to legal counsel, and preparing ballot

Board for the meeting

Governance

BP 5 Director Compliance This process is to ensure that all Board Members have completed the appropriate compliance documents and that they are on file at CSCS

BP 6 Board Meeting Management This process includes preparing decks for Board Meetings, minutes, binders

This process is to ensure that pricing, DC item mappings, DC mark-ups, and daily feeds from the supplier's, brand's, and distributor's are audited

BP 15 A Data Integrity Audits

and validated before being integrated into the system (Havi).

Analytics BP 15 B Price Index (Commodity pricing tracking and forecasting) This process includes tracking and forecasting commodity prices

BP 15 C Modified PPI or Performance Tracking of the Co-ops This process includes measuring the annual performance of the Co-ops agaist the modified PPI.

BP 15 (D) Commodity Quintile Tracking Tracking hedging positions of several commodities.

Produce DC BP 690 Produce Distributor Compliance This process is to assure that produce distributors comply with CSCS's produce spec requirements and purchases are made from approved

Compliance vendors.