Page 10 - Module 11 The Fibonacci science

P. 10

Module 11 – The Fibonacci Science

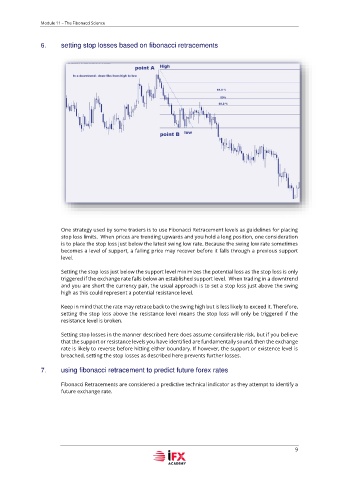

6. setting stop losses based on fibonacci retracements

One strategy used by some traders is to use Fibonacci Retracement levels as guidelines for placing

stop loss limits. When prices are trending upwards and you hold a long position, one consideration

is to place the stop loss just below the latest swing low rate. Because the swing low rate sometimes

becomes a level of support, a falling price may recover before it falls through a previous support

level.

Setting the stop loss just below the support level minimizes the potential loss as the stop loss is only

triggered if the exchange rate falls below an established support level. When trading in a downtrend

and you are short the currency pair, the usual approach is to set a stop loss just above the swing

high as this could represent a potential resistance level.

Keep in mind that the rate may retrace back to the swing high but is less likely to exceed it. Therefore,

setting the stop loss above the resistance level means the stop loss will only be triggered if the

resistance level is broken.

Setting stop losses in the manner described here does assume considerable risk, but if you believe

that the support or resistance levels you have identified are fundamentally sound, then the exchange

rate is likely to reverse before hitting either boundary. If however, the support or existence level is

breached, setting the stop losses as described here prevents further losses.

7. using fibonacci retracement to predict future forex rates

Fibonacci Retracements are considered a predictive technical indicator as they attempt to identify a

future exchange rate.

9