Page 9 - Module 11 The Fibonacci science

P. 9

Module 11 – The Fibonacci Science

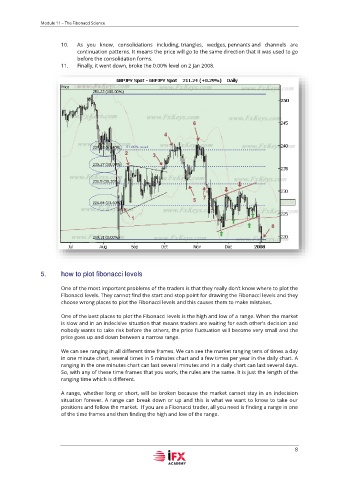

10. As you know, consolidations including, triangles, wedges, pennants and channels are

continuation patterns. It means the price will go to the same direction that it was used to go

before the consolidation forms.

11. Finally, it went down, broke the 0.00% level on 2 Jan 2008.

5. how to plot fibonacci levels

One of the most important problems of the traders is that they really don’t know where to plot the

Fibonacci levels. They cannot find the start and stop point for drawing the Fibonacci levels and they

choose wrong places to plot the Fibonacci levels and this causes them to make mistakes.

One of the best places to plot the Fibonacci levels is the high and low of a range. When the market

is slow and in an indecisive situation that means traders are waiting for each other’s decision and

nobody wants to take risk before the others, the price fluctuation will become very small and the

price goes up and down between a narrow range.

We can see ranging in all different time frames. We can see the market ranging tens of times a day

in one minute chart, several times in 5 minutes chart and a few times per year in the daily chart. A

ranging in the one minutes chart can last several minutes and in a daily chart can last several days.

So, with any of these time frames that you work, the rules are the same. It is just the length of the

ranging time which is different.

A range, whether long or short, will be broken because the market cannot stay in an indecision

situation forever. A range can break down or up and this is what we want to know to take our

positions and follow the market. If you are a Fibonacci trader, all you need is finding a range in one

of the time frames and then finding the high and low of the range.

8