Page 13 - Module 11 The Fibonacci science

P. 13

Module 11 – The Fibonacci Science

Example during a

downtrend

The pair had a strong up move and you need more evidence to confirm your entry.

Looking back, one can easily spot a previous price peak at 1.0510, an earlier resistance. The current

uptrend took out this resistance, so it will very likely now function as a support.

Let’s just draw a horizontal line from this peak and see if its level also matches up with any Fib level.

Voila! It’s almost a dead ringer for the 0.500 level. This is therefore a support area and a buying level

with a good chance that the price will bounce off it in the direction of the earlier move.

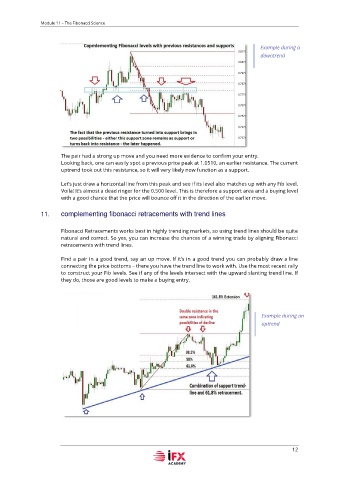

11. complementing fibonacci retracements with trend lines

Fibonacci Retracements works best in highly trending markets, so using trend lines should be quite

natural and correct. So yes, you can increase the chances of a winning trade by aligning Fibonacci

retracements with trend lines.

Find a pair in a good trend, say an up move. If it’s in a good trend you can probably draw a line

connecting the price bottoms – there you have the trend line to work with. Use the most recent rally

to construct your Fib levels. See if any of the levels intersect with the upward slanting trend line. If

they do, those are good levels to make a buying entry.

Example during an

uptrend

12