Page 12 - Module 11 The Fibonacci science

P. 12

Module 11 – The Fibonacci Science

8. Where to take Profit?

Previous supports may tend to turn into resistances and previous resistances have the tendency to

turn into supports. This tendency helps you using the various retracement levels, themselves, as

profit targets. For example, if during an uptrend the price retraces to 61.8% level, before turning back

towards the trend direction, then it may find resistances at 50% level, 38.2% level, 23.6% level and

then at the 0 level. All these levels provide you with profit taking targets.

One finer point to know here is that it's always better to put you take-profit order a few pips ahead

of the targeted level. If you are targeting a move back towards 61.8% retracement from the 38.2%

retracement for your long position, then put the take-profit order a few pips below the 61.8% level.

Once the retracement completes and the trend resumes, you may use Fibonacci extension levels as

profit targets. Don’t worry, we are going there now.

9. fibonacci levels as stop-loss

Fibonacci levels also help us in helping us in deciding the stop-loss order levels. Once we find a

retracement level acting as support and we enter a trend, you may use the previous level as the stop-

loss. Like profit targets, place your stop-loss order a few pips away from the identified level.

For example, you find a retracement getting resistance at 50% level during a downtrend and you e

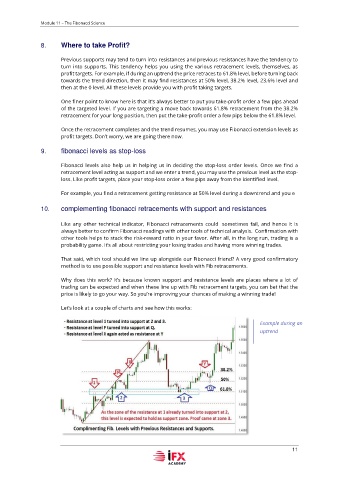

10. complementing fibonacci retracements with support and resistances

Like any other technical indicator, Fibonacci retracements could sometimes fail, and hence it is

always better to confirm Fibonacci readings with other tools of technical analysis. Confirmation with

other tools helps to stack the risk-reward ratio in your favor. After all, in the long run, trading is a

probability game. It’s all about restricting your losing trades and having more winning trades.

That said, which tool should we line up alongside our Fibonacci friend? A very good confirmatory

method is to use possible support and resistance levels with Fib retracements.

Why does this work? It’s because known support and resistance levels are places where a lot of

trading can be expected and when these line up with Fib retracement targets, you can bet that the

price is likely to go your way. So you’re improving your chances of making a winning trade!

Let’s look at a couple of charts and see how this works:

Example during an

uptrend

11