Page 11 - Module 11 The Fibonacci science

P. 11

Module 11 – The Fibonacci Science

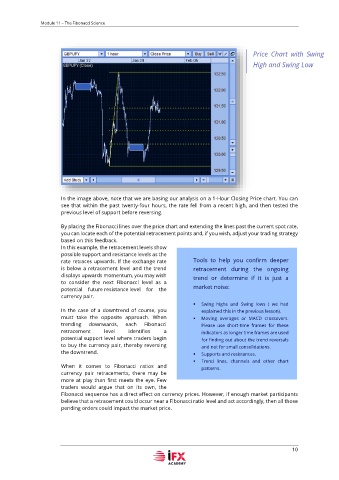

Price Chart with Swing

High and Swing Low

In the image above, note that we are basing our analysis on a 1-Hour Closing Price chart. You can

see that within the past twenty-four hours, the rate fell from a recent high, and then tested the

previous level of support before reversing.

By placing the Fibonacci lines over the price chart and extending the lines past the current spot rate,

you can locate each of the potential retracement points and, if you wish, adjust your trading strategy

based on this feedback.

In this example, the retracement levels show

possible support and resistance levels as the

rate retraces upwards. If the exchange rate Tools to help you confirm deeper

is below a retracement level and the trend retracement during the ongoing

displays upwards momentum, you may wish trend or determine if it is just a

to consider the next Fibonacci level as a

potential future resistance level for the market noise:

currency pair.

▪ Swing highs and Swing lows ( we had

In the case of a downtrend of course, you explained this in the previous lesson).

must take the opposite approach. When ▪ Moving averages or MACD crossovers.

trending downwards, each Fibonacci Please use short-time frames for these

retracement level identifies a indicators as longer time frames are used

potential support level where traders begin for finding out about the trend reversals

to buy the currency pair, thereby reversing and not for small consolidations.

the downtrend. ▪ Supports and resistances.

▪ Trend lines, channels and other chart

When it comes to Fibonacci ratios and patterns.

currency pair retracements, there may be

more at play than first meets the eye. Few

traders would argue that on its own, the

Fibonacci sequence has a direct effect on currency prices. However, if enough market participants

believe that a retracement could occur near a Fibonacci ratio level and act accordingly, then all those

pending orders could impact the market price.

10