Page 11 - Module & Head and Shoulders

P. 11

Module 7 – Head and Shoulders

Trade Tip #5

If you have to question the validity of a pattern, it probably isn’t worth the risk.

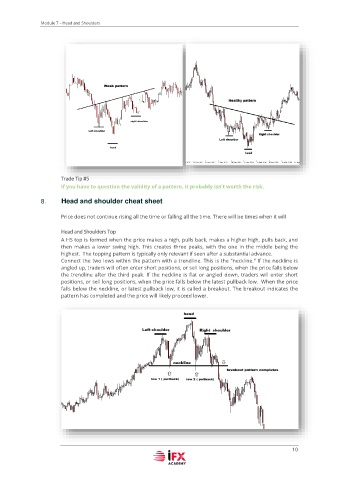

8. Head and shoulder cheat sheet

Price does not continue rising all the time or falling all the time. There will be times when it will

Head and Shoulders Top

A HS top is formed when the price makes a high, pulls back, makes a higher high, pulls back, and

then makes a lower swing high. This creates three peaks, with the one in the middle being the

highest. The topping pattern is typically only relevant if seen after a substantial advance.

Connect the two lows within the pattern with a trendline. This is the "neckline." If the neckline is

angled up, traders will often enter short positions, or sell long positions, when the price falls below

the trendline after the third peak. If the neckline is flat or angled down, traders will enter short

positions, or sell long positions, when the price falls below the latest pullback low. When the price

falls below the neckline, or latest pullback low, it is called a breakout. The breakout indicates the

pattern has completed and the price will likely proceed lower.

10