Page 12 - Module & Head and Shoulders

P. 12

Module 7 – Head and Shoulders

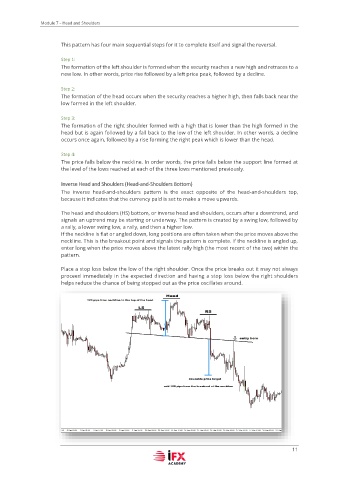

This pattern has four main sequential steps for it to complete itself and signal the reversal.

Step 1:

The formation of the left shoulder is formed when the security reaches a new high and retraces to a

new low. In other words, price rise followed by a left price peak, followed by a decline.

Step 2:

The formation of the head occurs when the security reaches a higher high, then falls back near the

low formed in the left shoulder.

Step 3:

The formation of the right shoulder formed with a high that is lower than the high formed in the

head but is again followed by a fall back to the low of the left shoulder. In other words, a decline

occurs once again, followed by a rise forming the right peak which is lower than the head.

Step 4:

The price falls below the neckline. In order words, the price falls below the support line formed at

the level of the lows reached at each of the three lows mentioned previously.

Inverse Head and Shoulders (Head-and-Shoulders Bottom)

The inverse head-and-shoulders pattern is the exact opposite of the head-and-shoulders top,

because it indicates that the currency paid is set to make a move upwards.

The head and shoulders (HS) bottom, or inverse head and shoulders, occurs after a downtrend, and

signals an uptrend may be starting or underway. The pattern is created by a swing low, followed by

a rally, a lower swing low, a rally, and then a higher low.

If the neckline is flat or angled down, long positions are often taken when the price moves above the

neckline. This is the breakout point and signals the pattern is complete. If the neckline is angled up,

enter long when the price moves above the latest rally high (the most recent of the two) within the

pattern.

Place a stop loss below the low of the right shoulder. Once the price breaks out it may not always

proceed immediately in the expected direction and having a stop loss below the right shoulders

helps reduce the chance of being stopped out as the price oscillates around.

11