Page 13 - Module & Head and Shoulders

P. 13

Module 7 – Head and Shoulders

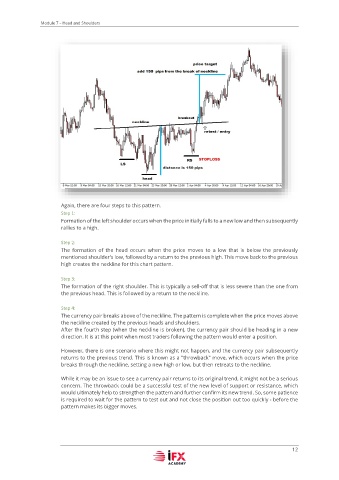

Again, there are four steps to this pattern.

Step 1:

Formation of the left shoulder occurs when the price initially falls to a new low and then subsequently

rallies to a high.

Step 2:

The formation of the head occurs when the price moves to a low that is below the previously

mentioned shoulder's low, followed by a return to the previous high. This move back to the previous

high creates the neckline for this chart pattern.

Step 3:

The formation of the right shoulder. This is typically a sell-off that is less severe than the one from

the previous head. This is followed by a return to the neckline.

Step 4:

The currency pair breaks above of the neckline. The pattern is complete when the price moves above

the neckline created by the previous heads and shoulders.

After the fourth step (when the neckline is broken), the currency pair should be heading in a new

direction. It is at this point when most traders following the pattern would enter a position.

However, there is one scenario where this might not happen, and the currency pair subsequently

returns to the previous trend. This is known as a "throwback" move, which occurs when the price

breaks through the neckline, setting a new high or low, but then retreats to the neckline.

While it may be an issue to see a currency pair returns to its original trend, it might not be a serious

concern. The throwback could be a successful test of the new level of support or resistance, which

would ultimately help to strengthen the pattern and further confirm its new trend. So, some patience

is required to wait for the pattern to test out and not close the position out too quickly - before the

pattern makes its bigger moves.

12