Page 8 - Module & Head and Shoulders

P. 8

Module 7 – Head and Shoulders

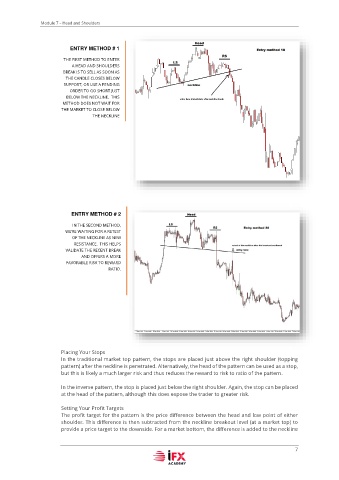

ENTRY METHOD # 1

THE FIRST METHOD TO ENTER

A HEAD AND SHOULDERS

BREAK IS TO SELL AS SOON AS

THE CANDLE CLOSES BELOW

SUPPORT, OR USE A PENDING

ORDER TO GO SHORT JUST

BELOW THE NECKLINE. THIS

METHOD DOES NOT WAIT FOR

THE MARKET TO CLOSE BELOW

THE NECKLINE

ENTRY METHOD # 2

IN THE SECOND METHOD,

WE’RE WAITING FOR A RETEST

OF THE NECKLINE AS NEW

RESISTANCE. THIS HELPS

VALIDATE THE RECENT BREAK

AND OFFERS A MORE

FAVORABLE RISK TO REWARD

RATIO.

Placing Your Stops

In the traditional market top pattern, the stops are placed just above the right shoulder (topping

pattern) after the neckline is penetrated. Alternatively, the head of the pattern can be used as a stop,

but this is likely a much larger risk and thus reduces the reward to risk to ratio of the pattern.

In the inverse pattern, the stop is placed just below the right shoulder. Again, the stop can be placed

at the head of the pattern, although this does expose the trader to greater risk.

Setting Your Profit Targets

The profit target for the pattern is the price difference between the head and low point of either

shoulder. This difference is then subtracted from the neckline breakout level (at a market top) to

provide a price target to the downside. For a market bottom, the difference is added to the neckline

7