Page 9 - Module & Head and Shoulders

P. 9

Module 7 – Head and Shoulders

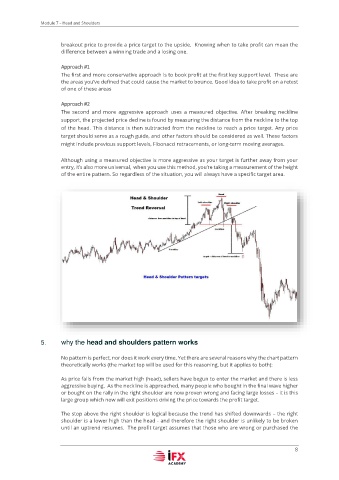

breakout price to provide a price target to the upside. Knowing when to take profit can mean the

difference between a winning trade and a losing one.

Approach #1

The first and more conservative approach is to book profit at the first key support level. These are

the areas you’ve defined that could cause the market to bounce. Good idea to take profit on a retest

of one of these areas

Approach #2

The second and more aggressive approach uses a measured objective. After breaking neckline

support, the projected price decline is found by measuring the distance from the neckline to the top

of the head. This distance is then subtracted from the neckline to reach a price target. Any price

target should serve as a rough guide, and other factors should be considered as well. These factors

might include previous support levels, Fibonacci retracements, or long-term moving averages.

Although using a measured objective is more aggressive as your target is further away from your

entry, it’s also more universal, when you use this method, you’re taking a measurement of the height

of the entire pattern. So regardless of the situation, you will always have a specific target area.

5. why the head and shoulders pattern works

No pattern is perfect, nor does it work every time. Yet there are several reasons why the chart pattern

theoretically works (the market top will be used for this reasoning, but it applies to both):

As price falls from the market high (head), sellers have begun to enter the market and there is less

aggressive buying. As the neckline is approached, many people who bought in the final wave higher

or bought on the rally in the right shoulder are now proven wrong and facing large losses – it is this

large group which now will exit positions driving the price towards the profit target.

The stop above the right shoulder is logical because the trend has shifted downwards – the right

shoulder is a lower high than the head - and therefore the right shoulder is unlikely to be broken

until an uptrend resumes. The profit target assumes that those who are wrong or purchased the

8