Page 77 - ie2 August 2019

P. 77

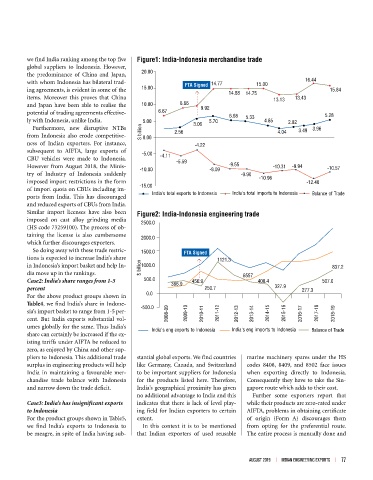

we find India ranking among the top five Figure1: India-Indonesia merchandise trade

global suppliers to Indonesia. However,

the predominance of China and Japan, 20.00

with whom Indonesia has bilateral trad- FTA Signed 14.77 15.00 16.44

ing agreements, is evident in some of the 15.00 14.88 14.75 15.84

items. Moreover this proves that China 13.13 13.43

and Japan have been able to realise the 10.00 8.66 9.92

potential of trading agreements effective- 6.67 6.68 5.28

ly with Indonesia, unlike India. 5.00 3.06 5.70 5.33 4.85 2.82

Furthermore, new disruptive NTBs 3.49 3.96

from Indonesia also erode competitive- $ billion 0.00 2.56 4.04

ness of Indian exporters. For instance, -4.22

subsequent to AIFTA, large exports of -5.00

CBU vehicles were made to Indonesia. -4.11 -5.59

However from August 2018, the Minis- -10.00 -8.09 -9.55 -10.31 -9.94 -10.57

try of Industry of Indonesia suddenly -9.90 -10.96

imposed import restrictions in the form -12.48

of import quota on CBUs including im- -15.00 India's total imports to Indonesia

ports from India. This has discouraged India's total exports to Indonesia Balance of Trade

and reduced exports of CBUs from India.

Similar import licenses have also been Figure2: India-Indonesia engineering trade

imposed on cast alloy grinding media 2500.0

(HS code 73259100). The process of ob-

taining the license is also cumbersome 2000.0

which further discourages exporters.

So doing away with these trade restric- 1500.0 FTA Signed

tions is expected to increase India’s share 1121.3

in Indonesia’s import basket and help In- $ billion 1000.0 837.2

dia move up in the rankings. 6557

Case2: India’s share ranges from 1-5 500.0 366.9 456.9 400.4 507.0

percent 250.7 327.9 277.3

For the above product groups shown in 0.0

Table4, we find India’s share in Indone- -500.0

sia’s import basket to range from 1-5 per- 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19

cent. But India exports substantial vol-

umes globally for the same. Thus India’s India's eng exports to Indonesia India's eng imports to Indonesia Balance of Trade

share can certainly be increased if the ex-

isting tariffs under AIFTA be reduced to

zero, as enjoyed by China and other sup-

pliers to Indonesia. This additional trade stantial global exports. We find countries marine machinery spares under the HS

surplus in engineering products will help like Germany, Canada, and Switzerland codes 8408, 8409, and 8502 face issues

India in maintaining a favourable mer- to be important suppliers for Indonesia when exporting directly to Indonesia.

chandise trade balance with Indonesia for the products listed here. Therefore, Consequently they have to take the Sin-

and narrow down the trade deficit. India’s geographical proximity has given gapore route which adds to their cost.

no additional advantage to India and this Further some exporters report that

Case3: India’s has insignificant exports indicates that there is lack of level play- while their products are zero-rated under

to Indonesia ing field for Indian exporters to certain AIFTA, problems in obtaining certificate

For the product groups shown in Table5, extent. of origin (Form A) discourages them

we find India’s exports to Indonesia to In this context it is to be mentioned from opting for the preferential route.

be meagre, in spite of India having sub- that Indian exporters of used reusable The entire process is manually done and

AUGUST 2019 l INDIAN ENGINEERING EXPORTS l 77