Page 12 - Parkside Gasification & Pellet Plant Report 081117_Neat

P. 12

Potential for upside increase from 0.09c / kw to 13 c/kw

Can be lowered with a National distribution deal

Can be lowered with a National distribution deal

Rising power costs will consolidate this figure

Extra sales volume with increased capacity

Rising gas costs will consolidate this figure

Comments

Weighting

Medium

Medium

Low

Low

Risk

Low

Low

549,600

13,225,000

637,500

2374957.52

18.0%

478307.52

382550

$102,000

225,000

No. workers Comments Total Parts Labour This is a max. labour est ‐ likely lower in reality $730,000 490,000.00 $ $240,000 6 $112K p.a. in accumulated (non cash) wear and tear cost engine replacement cost $64,000 4,000.00 $ 60,000.00 $ 1 Already allowed for in production costs 0 1.5 $794,000 Obtain ARENA co‐funding for on site energy plant. This will boost ROI numbers further. Negotiate a stronger FIT energy price with retailers Additional profit from extra sales due to higher kiln throughput volume CEFC have recently been directed to invest heavily in renew

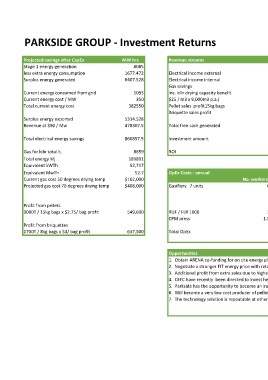

PARKSIDE GROUP ‐ Investment Returns

Revenue streams Electrical income external Electrical income internal Gas savings Inc. kiln drying capacity benefit $25 / m3 x 9,000m3 p.a.) Pellet sales profit15kg bags Briquette sales profit Total free cash generated Investment amount ROI OpEx Costs ‐ annual Gasifiers: 7 units RUF / FLR 1000 CPM press Total OpEx Opportunities 1. 2. 3. 4. 5. 6. 7.

MW hrs 8085 1677.472 6407.528 1093 350 382550 5314.528 478307.5 860857.5 8659 189891 52,747 52.7 $102,000 $408,000 549,600 637,500

Projected savings after CapEx Stage 1 energy generation less extra energy consumption Surplus energy generated Current energy consumed from grid Current energy cost / MW Total current energy cost Surplus energy exported Revenue at $90 / Mw Total electrical energy savings Gas for kiln total lt. Total energy Mj Equivalent kWTh Equivalent MwTh Current gas cost 50 degrees drying temp Projected gas cost 70 degrees drying temp Profit from pellets 3000T / 15kg bags x $2.75/ bag profit Profit from briquettes 1700T / 8kg bags x $3/ bag profit