Page 17 - NYMets_2018_Benefits_Guide

P. 17

BACK TO

HOME

PLATE

at-bat: dental benefits

We offer two dental plan options through Delta Dental: If you receive care from a non-network dentist, you are still

covered, however, you will be responsible for any amounts

Premier Dental Preferred Provider Organization (DPPO)

above what the plan covers and Delta Dental’s Reasonable &

DeltaCare USA Dental Health Maintenance Organization Customary (R&C) charges. This is considered balance billing.

(DHMO)

With Delta Dental, you have access to a large network of About a Dental Health Maintenance

dental providers nationwide. organization (DHMo)

With a DHMO, you have access to in-network dental providers

About a Dental Preferred provider organization only and you must call or go online to Delta Dental to

(DpPo) designate a primary dentist at time of enrollment. There is no

A DPPO gives you the flexibility to go to any network dentist annual deductible and no annual benefits maximum. You pay

you wish. You do not need to select a primary dentist to a fixed dollar copay for services according to DeltaCare USA’s

manage your dental care. However, you receive a higher level fee schedule. The DHMO utilizes the DeltaCare USA network,

of benefits when you see a network dentist. That is because which has a smaller network of dentists and may or may not

network dentists have contracted with Delta Dental to offer have the same network of dentists as in the PPO plan.

negotiated rates. You do not need to file claim forms; your Benefits outlined below are what the member pays out-of-

dentist will do that for you. The DPPO utilizes the PPO and pocket. For more information on coverage, limitations and

Premier networks of dentists. exclusions, refer to the Delta Dental benefit summaries.

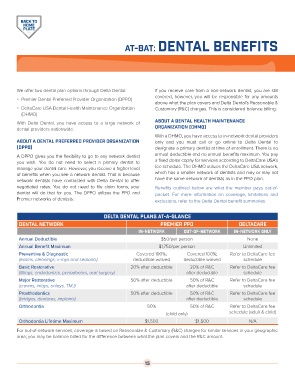

Delta Dental Plans at-a-glance

DENTAL NETWORK Premier PPO deltacare

in-network out-of-network in-network only

Annual Deductible $50/per person None

Annual Benefit Maximum $1,750/per person Unlimited

Preventive & Diagnostic Covered 100%; Covered 100%; Refer to DeltaCare fee

(exams, cleanings, x-rays and sealants) deductible waived deductible waived schedule

Basic Restorative 20% after deductible 20% of R&C Refer to DeltaCare fee

(fillings, endodontics, periodontics, oral surgery) after deductible schedule

Major Restorative 50% after deductible 50% of R&C Refer to DeltaCare fee

(crowns, inlays, onlays, TMJ) after deductible schedule

Prosthodontics 50% after deductible 50% of R&C Refer to DeltaCare fee

(bridges, dentures, implants) after deductible schedule

Orthodontia 50% 50% of R&C Refer to DeltaCare fee

(child only) schedule (adult & child)

Orthodontia Lifetime Maximum $1,500 $1,500 N/A

For out-of-network services, coverage is based on Reasonable & Customary (R&C) charges for similar services in your geographic

area; you may be balance billed for the difference between what the plan covers and the R&C amount.

15