Page 12 - NYMets_2018_Benefits_Guide

P. 12

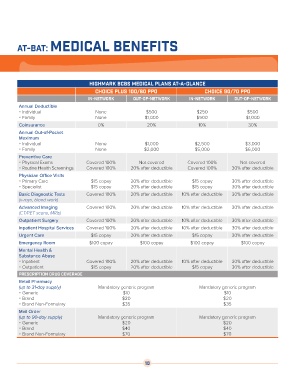

at-bat: medical benefits

Highmark bcbs medical plans at-a-glance

Choice Plus 100/80 PPO Choice 90/70 PPO

in-network out-of-network in-network out-of-network

Annual Deductible

Individual None $500 $250 $500

Family None $1,000 $500 $1,000

Coinsurance 0% 20% 10% 30%

Annual Out-of-Pocket

Maximum

Individual None $1,000 $2,500 $3,000

Family None $2,000 $5,000 $6,000

Preventive Care

Physical Exams Covered 100% Not covered Covered 100% Not covered

Routine Health Screenings Covered 100% 20% after deductible Covered 100% 30% after deductible

Physician Office Visits

Primary Care $15 copay 20% after deductible $15 copay 30% after deductible

Specialist $15 copay 20% after deductible $15 copay 30% after deductible

Basic Diagnostic Tests Covered 100% 20% after deductible 10% after deductible 30% after deductible

(x-rays, blood work)

Advanced Imaging Covered 100% 20% after deductible 10% after deductible 30% after deductible

(CT/PET scans, MRIs)

Outpatient Surgery Covered 100% 20% after deductible 10% after deductible 30% after deductible

Inpatient Hospital Services Covered 100% 20% after deductible 10% after deductible 30% after deductible

Urgent Care $15 copay 20% after deductible $15 copay 30% after deductible

Emergency Room $100 copay $100 copay $100 copay $100 copay

Mental Health &

Substance Abuse

Inpatient Covered 100% 20% after deductible 10% after deductible 30% after deductible

Outpatient $15 copay 20% after deductible $15 copay 30% after deductible

Prescription Drug Coverage

Retail Pharmacy

(up to 31-day supply) Mandatory generic program Mandatory generic program

Generic $10 $10

Brand $20 $20

Brand Non-Formulary $35 $35

Mail Order

(up to 90-day supply) Mandatory generic program Mandatory generic program

Generic $20 $20

Brand $40 $40

Brand Non-Formulary $70 $70

10