Page 10 - NYMets_2018_Benefits_Guide

P. 10

at-bat: medical benefits

We offer three medical plan options through Highmark BCBS: About a High Deductible Health Plan

Choice Plus PPO (100/80) A High Deductible Health Plan (HDHP) is a medical plan

designed to lower health care costs by encouraging its

Choice PPO (90/70)

members to focus on preventive care, therefore making

Premier HDHP with HSA (80/60) insurance premiums more affordable.

About a Preferred provider organization (ppo) This plan is also a PPO but has higher deductibles that must be

met before the plan begins to pay benefits. It is designed to pay

A PPO gives you the flexibility to go to any doctor or hospital for basic preventive care; you pay for all other diagnostic care

you wish. It does not require you to select a primary care until the deductible is reached. The HDHP is offered in tandem

physician (PCP) or obtain referrals to see a specialist or go to the with a Health Savings Account (HSA). See next page for more

hospital. A PPO plan also gives you the freedom to go outside information on the HSA.

the network for care whenever you like. However, you will pay

more for your care if you use an out-of-network provider. How Does the High Deductible Health Plan Work?

The Premier HDHP is also a PPO plan, which offers the same

The chart below explains the differences between in-network network of doctors and works similar to a copay plan. In

and out-of-network coverage in a PPO plan. general, preventive care services are covered at 100% (no

deductible) in-network. Other in-network services are covered

at 80% after deductible. Prescription drugs including the mail

order program is also subject to a calendar year deductible.

Some prescriptions are covered at 100% if designated as

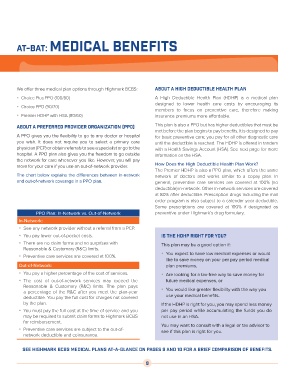

PPO Plan: In-Network vs. Out-of-Network preventive under Highmark’s drug formulary.

In-Network:

See any network provider without a referral from a PCP.

You pay lower out-of-pocket costs. Is the HDHP Right for You?

There are no claim forms and no surprises with This plan may be a good option if:

Reasonable & Customary (R&C) limits.

You expect to have low medical expenses or would

Preventive care services are covered at 100%.

like to save money on your per pay period medical

Out-of-Network: plan premiums,

You pay a higher percentage of the cost of services. Are looking for a tax-free way to save money for

The cost of out-of-network services may exceed the future medical expenses, or

Reasonable & Customary (R&C) limits. The plan pays

a percentage of the R&C after you meet the plan-year You would like greater flexibility with the way you

deductible. You pay the full cost for charges not covered use your medical benefits.

by the plan. If the HDHP is right for you, you may spend less money

You must pay the full cost at the time of service and you per pay period while accumulating the funds you do

may be required to submit claim forms to Highmark BCBS not use in an HSA.

for reimbursement.

You may want to consult with a legal or tax advisor to

Preventive care services are subject to the out-of- see if this plan is right for you.

network deductible and coinsurance.

See Highmark Bcbs medical plans at-a-glance on pages 9 and 10 for a brief comparison of benefits.

8