Page 57 - LGB Group

P. 57

Appendix 2

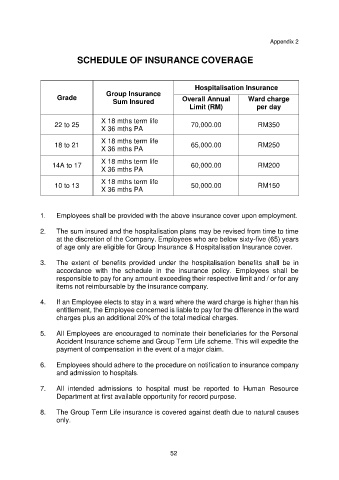

SCHEDULE OF INSURANCE COVERAGE

Hospitalisation Insurance

Group Insurance

Grade Overall Annual Ward charge

Sum Insured

Limit (RM) per day

X 18 mths term life

22 to 25 70,000.00 RM350

X 36 mths PA

X 18 mths term life

18 to 21 65,000.00 RM250

X 36 mths PA

X 18 mths term life

14A to 17 60,000.00 RM200

X 36 mths PA

X 18 mths term life

10 to 13 50,000.00 RM150

X 36 mths PA

1. Employees shall be provided with the above insurance cover upon employment.

2. The sum insured and the hospitalisation plans may be revised from time to time

at the discretion of the Company. Employees who are below sixty-five (65) years

of age only are eligible for Group Insurance & Hospitalisation Insurance cover.

3. The extent of benefits provided under the hospitalisation benefits shall be in

accordance with the schedule in the insurance policy. Employees shall be

responsible to pay for any amount exceeding their respective limit and / or for any

items not reimbursable by the insurance company.

4. If an Employee elects to stay in a ward where the ward charge is higher than his

entitlement, the Employee concerned is liable to pay for the difference in the ward

charges plus an additional 20% of the total medical charges.

5. All Employees are encouraged to nominate their beneficiaries for the Personal

Accident Insurance scheme and Group Term Life scheme. This will expedite the

payment of compensation in the event of a major claim.

6. Employees should adhere to the procedure on notification to insurance company

and admission to hospitals.

7. All intended admissions to hospital must be reported to Human Resource

Department at first available opportunity for record purpose.

8. The Group Term Life insurance is covered against death due to natural causes

only.

52