Page 4 - Northbridge Companies 2018 OE Guide_Fomatting corrections (002)HLD

P. 4

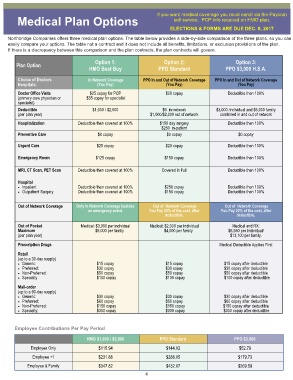

If you want medical coverage you must enroll via the Paycom

self service. PCP info required on HMO plan.

Medical Plan Options

ELECTIONS & FORMS ARE DUE DEC. 8, 2017

Northbridge Companies offers three medical plan options. The table below provides a side-by-side comparison of the three plans, so you can

easily compare your options. The table not a contract and it does not include all benefits, limitations, or exclusion provisions of the plan.

If there is a discrepancy between this comparison and the plan contracts, the plan contracts will govern.

Option 1: Option 2: Option 3:

Plan Option

HMO Best Buy PPO Standard PPO $3,000 H.S.A.

Choice of Doctors In Network Coverage PPO In and Out of Network Coverage PPO In and Out of Network Coverage

Hospitals: (You Pay) (You Pay) (You Pay)

Doctor Office Visits $25 copay for PCP $20 copay Deductible then 100%

(primary care physician or $35 copay for specialist

specialist)

Deductible $1,000 / $2,000 $0 in-network $3,000 /individual and $6,000 family

(per plan year) $1,000/$2,000 out of network combined in and out of network

Hospitalization Deductible then covered at 100% $150 day surgery Deductible then 100%

$250 in-patient

Preventive Care $0 copay $0 copay $0 copay

Urgent Care $25 copay $20 copay Deductible then 100%

Emergency Room $125 copay $150 copay Deductible then 100%

MRI, CT Scan, PET Scan Deductible then covered at 100% Covered in Full Deductible then 100%

Hospital

• Inpatient Deductible then covered at 100% $250 copay Deductible then 100%

• Outpatient Surgery Deductible then covered at 100% $150 copay Deductible then 100%

Out of Network Coverage Only In Network Coverage besides Out of Network Coverage Out of Network Coverage

an emergency event. You Pay 20% of the cost, after You Pay 20% of the cost, after

deductible. deductible.

Out of Pocket Medical: $3,000 per individual Medical: $2,000 per individual Medical and RX:

Maximum $6,000 per family $4,000 per family $6,550 per individual/

(per plan year) $13,100 per family.

Prescription Drugs Medical Deductible Applies First

Retail

(up to a 30-day supply)

• Generic: $15 copay $15 copay $15 copay after deductible

• Preferred: $30 copay $30 copay $30 copay after deductible

• Non-Preferred: $50 copay $50 copay $50 copay after deductible

• Specialty $100 copay $100 copay $100 copay after deductible

Mail-order

(up to a 90-day supply)

• Generic: $30 copay $30 copay $30 copay after deductible

• Preferred: $60 copay $60 copay $60 copay after deductible

• Non-Preferred: $150 copay $150 copay $150 copay after deductible

• Specialty: $300 copay $300 copay $300 copay after deductible

Employee Contributions Per Pay Period

HMO $1,000 / $2,000 PPO Standard PPO $3,000

Employee Only $115.94 $144.02 $52.79

Employee +1 $231.88 $288.05 $179.73

Employee & Family $347.82 $432.07 $269.59

4