Page 5 - Northbridge Companies 2018 OE Guide_Fomatting corrections (002)HLD

P. 5

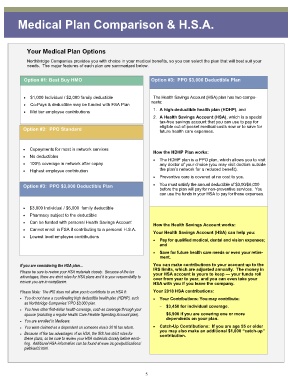

Medical Plan Comparison & H.S.A.

Your Medical Plan Options

Northbridge Companies provides you with choice in your medical benefits, so you can select the plan that will best suit your

needs. The major features of each plan are summarized below.

Option #1: Best Buy HMO Option #3: PPO $3,000 Deductible Plan

• $1,000 Individual / $2,000 family deductible The Health Savings Account (HSA) plan has two compo-

nents:

• Co-Pays & deductible may be funded with FSA Plan

1. A high-deductible health plan (HDHP), and

• Mid tier employee contributions

2. A Health Savings Account (HSA), which is a special

tax-free savings account that you can use to pay for

eligible out-of-pocket medical costs now or to save for

Option #2: PPO Standard future health care expenses.

• Copayments for most in network services

How the HDHP Plan works:

• No deductibles

• The HDHP plan is a PPO plan, which allows you to visit

• 100% coverage in network after copay any doctor of your choice (you may visit doctors outside

• Highest employee contribution the plan’s network for a reduced benefit).

• Preventive care is covered at no cost to you.

Option #3: PPO $3,000 Deductible Plan • You must satisfy the annual deductible of $3,00/$6,000

before the plan will pay for non-preventive services. You

can use the funds in your HSA to pay for these expenses.

• $3,000 Individual / $6,000 family deductible

• Pharmacy subject to the deductible

• Can be funded with personal Health Savings Account

How the Health Savings Account works:

• Cannot enroll in FSA if contributing to a personal H.S.A.

Your Health Savings Account (HSA) can help you:

• Lowest level employee contributions

• Pay for qualified medical, dental and vision expenses;

and

• Save for future health care needs or even your retire-

ment.

If you are considering the HSA plan… You can make contributions to your account up to the

Please be sure to review your HSA materials closely. Because of the tax IRS limits, which are adjusted annually. The money in

your HSA account is yours to keep — your funds roll

advantages, there are strict rules for HSA plans and it is your responsibility to over from year to year, and you can even take your

ensure you are in compliance. HSA with you if you leave the company.

Please Note: The IRS does not allow you to contribute to an HSA if: Your 2018 HSA contributions:

• You do not have a coordinating high deductible health plan (HDHP), such • Your Contributions: You may contribute:

as Northbridge Companies’ PPO $3,000 plan.

• You have other first-dollar health coverage, such as coverage through your $3,450 for individual coverage.

spouse (including a regular Health Care Flexible Spending Account plan). $6,900 if you are covering one or more

• You are enrolled in Medicare. dependents on your plan.

• You were claimed as a dependent on someone else’s 2018 tax return. • Catch-Up Contributions: If you are age 55 or older

• Because of the tax advantages of an HSA, the IRS has strict rules for you may also make an additional $1,000 “catch-up”

contribution.

these plans, so be sure to review your HSA materials closely before enrol-

ling. Additional HSA information can be found at www.irs.gov/publications/

p969/ar02.html.

5