Page 10 - Northbridge Companies 2018 OE Guide_Fomatting corrections (002)HLD

P. 10

Flexible Spending Accounts

Health Care Flexible Spending Accounts (FSA) allow you the Health Care FSA

opportunity to pay for qualified health expenses with pretax

money. Benefit Strategies is administering Northbridge’s FSA.

• Minimum contribution is $100. You may

When you participate in an FSA, your Federal Income Tax, Social set aside up to $1,250 annually.

Security and Medicare Tax withholdings will be reduced, and the

savings you can enjoy with an FSA can be quite substantial. See • Use your Health Care FSA to pay for

the Pretax Savings Illustration below for an example. qualified health expenses for yourself that

are not covered by your medical, dental or

You must complete a Benefit Strategies FSA enrollment form vision plans.

if you would like to participate.

• Can be used for yourself and your eligible

dependents.

• Includes a debit card for easy access to

your funds.

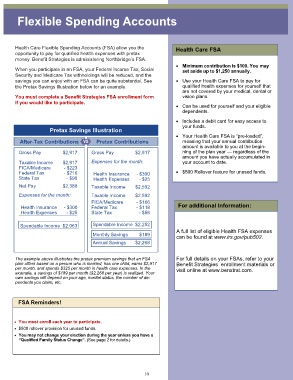

Pretax Savings Illustration

• Your Health Care FSA is “pre-loaded”,

After-Tax Contributions VS Pretax Contributions meaning that your annual contribution

amount is available to you at the begin-

Gross Pay $2,917 Gross Pay $2,917 ning of the plan year — regardless of the

amount you have actually accumulated in

Taxable Income $2,917 Expenses for the month: your account to date.

FICA/Medicare - $223

Federal Tax - $216 Health Insurance - $300 • $500 Rollover feature for unused funds.

State Tax - $90 Health Expenses - $25

Net Pay $2,388 Taxable Income $2,592

Expenses for the month: Taxable Income $2,592

FICA/Medicare - $166

Health Insurance - $300 Federal Tax - $118 For additional Information:

Health Expenses - $25 State Tax - $56

Spendable Income $2,063 Spendable Income $2,252

A full list of eligible Health FSA expenses

Monthly Savings $189

can be found at www.irs.gov/pub502.

Annual Savings $2,268

The example above illustrates the pretax premium savings that an FSA For full details on your FSAs, refer to your

plan offers based on a person who is married, has one child, earns $2,917 Benefit Strategies enrollment materials or

per month, and spends $325 per month in health care expenses. In the visit online at www.benstrat.com.

example, a savings of $189 per month ($2,268 per year) is realized. Your

own savings will depend on your age, marital status, the number of de-

pendents you claim, etc.

FSA Reminders!

• You must enroll each year to participate.

• $500 rollover provision for unused funds.

• You may not change your election during the year unless you have a

“Qualified Family Status Change”. (See page 2 for details.)

10