Page 143 - ACFE Fraud Reports 2009_2020

P. 143

Detecting Fraud in Small departments can be effective in detecting fraud when they

Businesses are utilized by small businesses. We also found that frauds

in small businesses were much more likely to be detected

Frauds in small businesses (those with fewer than 100 em- by accident, suggesting that these organizations do not do

ployees) were less likely to be detected by a tip than occu- a good job of proactively detecting fraud.

pational frauds in general. They were also less likely to be

detected by internal audit or internal controls, which may Detecting Fraud in Not-for-Profit

be because many small organizations often lack strong Organizations

internal control structures or any type of internal audit

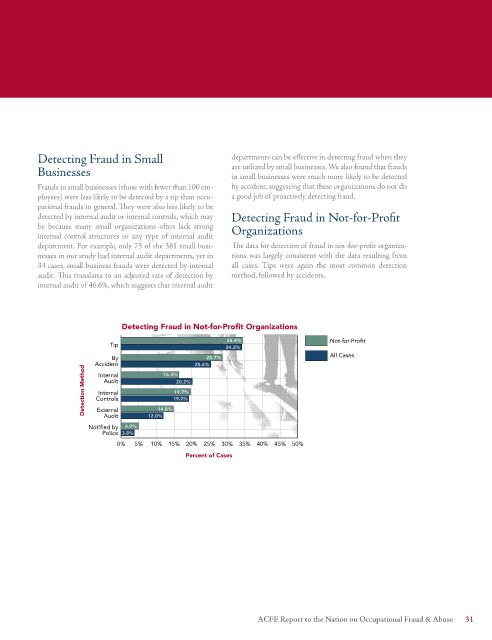

department. For example, only 73 of the 381 small busi- The data for detection of fraud in not-for-profit organiza-

nesses in our study had internal audit departments, yet in tions was largely consistent with the data resulting from

34 cases, small business frauds were detected by internal all cases. Tips were again the most common detection

audit. This translates to an adjusted rate of detection by method, followed by accidents.

internal audit of 46.6%, which suggests that internal audit

Detecting Fraud in Not-for-Profit Organizations

34.4% Not-for-Profit

Tip 34.2%

All Cases

By 28.7%

Accident 16.4% 25.4%

Detection Method Controls 14.8% 19.2%

Internal

Audit

20.2%

Internal

19.7%

External

Audit

Notified by 4.9% 12.0%

Police 3.8%

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%

Percent of Cases

ACFE Report to the Nation on Occupational Fraud & Abuse 1