Page 148 - ACFE Fraud Reports 2009_2020

P. 148

Limiting Fraud Losses

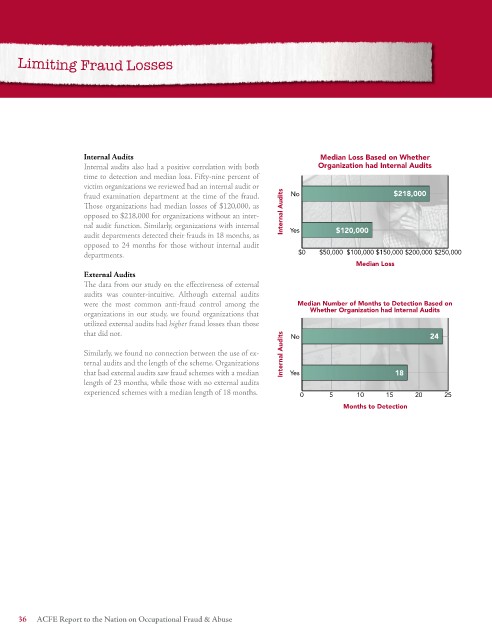

Internal Audits Median Loss Based on Whether

Internal audits also had a positive correlation with both Organization had Internal Audits

time to detection and median loss. Fifty-nine percent of

victim organizations we reviewed had an internal audit or

fraud examination department at the time of the fraud. No $218,000

Those organizations had median losses of $120,000, as

opposed to $218,000 for organizations without an inter- Internal Audits

nal audit function. Similarly, organizations with internal $120,000

audit departments detected their frauds in 18 months, as Yes

opposed to 24 months for those without internal audit

departments. $0 $50,000 $100,000 $150,000 $200,000 $250,000

Median Loss

External Audits

The data from our study on the effectiveness of external

audits was counter-intuitive. Although external audits

were the most common anti-fraud control among the Median Number of Months to Detection Based on

organizations in our study, we found organizations that Whether Organization had Internal Audits

utilized external audits had higher fraud losses than those

that did not. No 24

Similarly, we found no connection between the use of ex- Internal Audits

ternal audits and the length of the scheme. Organizations

that had external audits saw fraud schemes with a median Yes 18

length of 23 months, while those with no external audits

experienced schemes with a median length of 18 months. 0 5 10 15 20 25

Months to Detection

ACFE Report to the Nation on Occupational Fraud & Abuse