Page 340 - ACFE Fraud Reports 2009_2020

P. 340

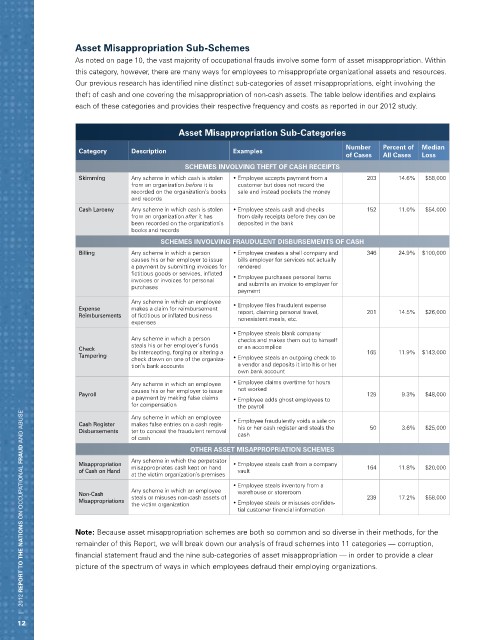

Asset Misappropriation Sub-Schemes

As noted on page 10, the vast majority of occupational frauds involve some form of asset misappropriation. Within

this category, however, there are many ways for employees to misappropriate organizational assets and resources.

Our previous research has identified nine distinct sub-categories of asset misappropriations, eight involving the

theft of cash and one covering the misappropriation of non-cash assets. The table below identifies and explains

each of these categories and provides their respective frequency and costs as reported in our 2012 study.

Asset Misappropriation Sub-Categories

Number Percent of Median

Category Description Examples

of Cases All Cases Loss

SCHEMES INVOLVING THEFT OF CASH RECEIPTS

skimming Any scheme in which cash is stolen • Employee accepts payment from a 203 14.6% $58,000

from an organization before it is customer but does not record the

recorded on the organization’s books sale and instead pockets the money

and records

cash larceny Any scheme in which cash is stolen • Employee steals cash and checks 152 11.0% $54,000

from an organization after it has from daily receipts before they can be

been recorded on the organization’s deposited in the bank

books and records

SCHEMES INVOLVING FRAUDULENT DISBURSEMENTS OF CASH

billing Any scheme in which a person • Employee creates a shell company and 346 24.9% $100,000

causes his or her employer to issue bills employer for services not actually

a payment by submitting invoices for rendered

fictitious goods or services, inflated • Employee purchases personal items

invoices or invoices for personal

purchases and submits an invoice to employer for

payment

Any scheme in which an employee

expense makes a claim for reimbursement • Employee files fraudulent expense 201 14.5% $26,000

report, claiming personal travel,

Reimbursements of fictitious or inflated business

expenses nonexistent meals, etc.

• Employee steals blank company

Any scheme in which a person checks and makes them out to himself

steals his or her employer’s funds

check by intercepting, forging or altering a or an accomplice 165 11.9% $143,000

tampering • Employee steals an outgoing check to

check drawn on one of the organiza-

tion’s bank accounts a vendor and deposits it into his or her

own bank account

Any scheme in which an employee • Employee claims overtime for hours

causes his or her employer to issue not worked

payroll 129 9.3% $48,000

a payment by making false claims • Employee adds ghost employees to

for compensation the payroll

| 2012 REPORT TO THE NATIONS on occupational FRAUD and abuse

Any scheme in which an employee

cash Register makes false entries on a cash regis- • Employee fraudulently voids a sale on

disbursements ter to conceal the fraudulent removal his or her cash register and steals the 50 3.6% $25,000

cash

of cash

OTHER ASSET MISAPPROPRIATION SCHEMES

Any scheme in which the perpetrator

Misappropriation misappropriates cash kept on hand • Employee steals cash from a company 164 11.8% $20,000

of cash on Hand vault

at the victim organization’s premises

• Employee steals inventory from a

Any scheme in which an employee warehouse or storeroom

non-cash steals or misuses non-cash assets of 239 17.2% $58,000

Misappropriations • Employee steals or misuses confiden-

the victim organization

tial customer financial information

Note: Because asset misappropriation schemes are both so common and so diverse in their methods, for the

remainder of this Report, we will break down our analysis of fraud schemes into 11 categories — corruption,

financial statement fraud and the nine sub-categories of asset misappropriation — in order to provide a clear

picture of the spectrum of ways in which employees defraud their employing organizations.

12