Page 445 - ACFE Fraud Reports 2009_2020

P. 445

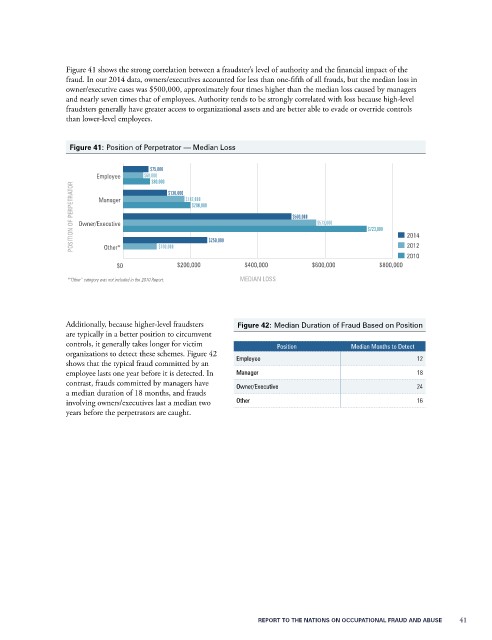

Figure 41 shows the strong correlation between a fraudster’s level of authority and the financial impact of the

fraud. In our 2014 data, owners/executives accounted for less than one-fifth of all frauds, but the median loss in

owner/executive cases was $500,000, approximately four times higher than the median loss caused by managers

and nearly seven times that of employees. Authority tends to be strongly correlated with loss because high-level

fraudsters generally have greater access to organizational assets and are better able to evade or override controls

than lower-level employees.

Figure 41: Position of Perpetrator — Median Loss

$75,000

Employee $60,000 $130,000

$80,000

POSITION OF PERPETRATOR Owner/Executive $182,000 $500,000 $573,000 $723,000 2014

Manager

$200,000

$250,000

2012

$100,000

Other*

2010

$0 $200,000 $400,000 $600,000 $800,000

*“Other” category was not included in the 2010 Report. MEDIAN LOSS

Additionally, because higher-level fraudsters Figure 42: Median Duration of Fraud Based on Position

are typically in a better position to circumvent

controls, it generally takes longer for victim Position Median Months to Detect

organizations to detect these schemes. Figure 42

shows that the typical fraud committed by an Employee 12

employee lasts one year before it is detected. In Manager 18

contrast, frauds committed by managers have Owner/Executive 24

a median duration of 18 months, and frauds

involving owners/executives last a median two Other 16

years before the perpetrators are caught.

REPORT TO THE NATIONS ON OCCUPATIONAL FRAUD AND ABUSE 41