Page 503 - ACFE Fraud Reports 2009_2020

P. 503

How Occupational Fraud Is Committed

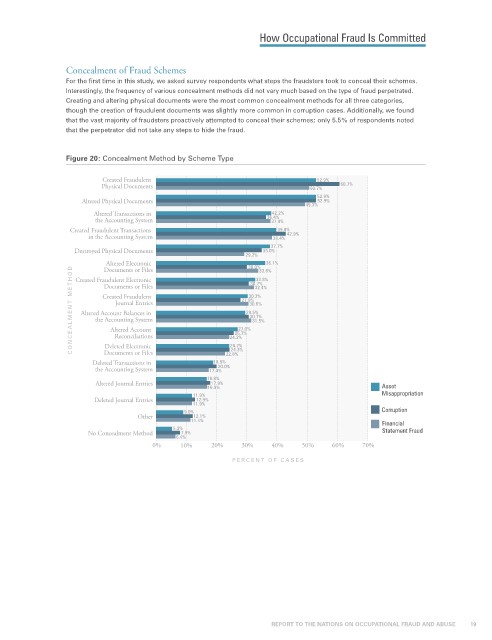

Concealment of Fraud Schemes

For the first time in this study, we asked survey respondents what steps the fraudsters took to conceal their schemes.

Interestingly, the frequency of various concealment methods did not vary much based on the type of fraud perpetrated.

Creating and altering physical documents were the most common concealment methods for all three categories,

though the creation of fraudulent documents was slightly more common in corruption cases. Additionally, we found

that the vast majority of fraudsters proactively attempted to conceal their schemes; only 5.5% of respondents noted

that the perpetrator did not take any steps to hide the fraud.

Figure 20: Concealment Method by Scheme Type

Created Fraudulent 52.9%

Physical Documents 50.7% 60.7%

52.9%

Altered Physical Documents 52.9%

49.3%

Altered Transactions in 42.2%

the Accounting System 36.4%

37.9%

Created Fraudulent Transactions 39.8% 42.9%

in the Accounting System 38.4%

37.7%

Destroyed Physical Documents 35.0%

29.2%

Altered Electronic 30.0% 33.8%

36.1%

Documents or Files

CONCEALMENT METHOD Altered Account Balances in 25.7% 29.5%

32.8%

Created Fraudulent Electronic

30.7%

Documents or Files

32.4%

Created Fraudulent

30.3%

27.9%

Journal Entries

30.6%

30.7%

the Accounting System

31.5%

Altered Account

27.0%

Reconciliations

24.2%

24.2%

Deleted Electronic

24.3%

Documents or Files

Deleted Transactions in 18.9% 22.8%

20.0%

the Accounting System 17.4%

16.8%

Altered Journal Entries 17.9%

16.9% Asset

11.9% Misappropriation

Deleted Journal Entries 12.9%

11.9%

9.0% Corruption

Other 12.1%

11.4% Financial

5.3%

No Concealment Method 7.9% Statement Fraud

6.4%

0% 10% 20% 30% 40% 50% 60% 70%

PERCENT OF CASES

REPORT TO THE NATIONS ON OCCUPATIONAL FRAUD AND ABUSE 19