Page 498 - ACFE Fraud Reports 2009_2020

P. 498

How Occupational Fraud Is Committed

Asset Misappropriation Sub-Schemes

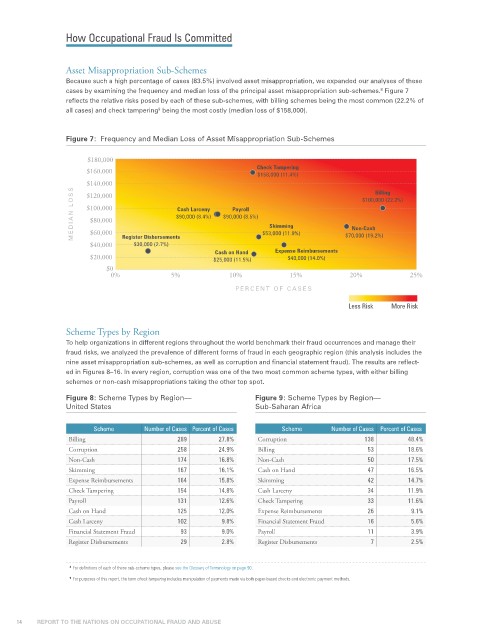

Because such a high percentage of cases (83.5%) involved asset misappropriation, we expanded our analyses of these

cases by examining the frequency and median loss of the principal asset misappropriation sub-schemes. Figure 7

8

reflects the relative risks posed by each of these sub-schemes, with billing schemes being the most common (22.2% of

all cases) and check tampering being the most costly (median loss of $158,000).

9

Figure 7: Frequency and Median Loss of Asset Misappropriation Sub-Schemes

$180,000

$160,000 Check Tampering

$158,000 (11.4%)

$140,000 Billing

MEDIAN L OSS $100,000 $90,000 (8.4%) $90,000 (8.5%) Skimming Non-Cash

$120,000

$100,000 (22.2%)

Payroll

Cash Larceny

$80,000

$60,000

$40,000 Register Disbursements $53,000 (11.9%) $70,000 (19.2%)

$30,000 (2.7%)

Cash on Hand Expense Reimbursements

$20,000 $25,000 (11.5%) $40,000 (14.0%)

$0

0% 5% 10% 15% 20% 25%

PERCENT OF CASES

Less Risk More Risk

Scheme Types by Region

To help organizations in different regions throughout the world benchmark their fraud occurrences and manage their

fraud risks, we analyzed the prevalence of different forms of fraud in each geographic region (this analysis includes the

nine asset misappropriation sub-schemes, as well as corruption and financial statement fraud). The results are reflect-

ed in Figures 8–16. In every region, corruption was one of the two most common scheme types, with either billing

schemes or non-cash misappropriations taking the other top spot.

Figure 8: Scheme Types by Region— Figure 9: Scheme Types by Region—

United States Sub-Saharan Africa

Scheme Number of Cases Percent of Cases Scheme Number of Cases Percent of Cases

Billing 289 27.8% Corruption 138 48.4%

Corruption 258 24.9% Billing 53 18.6%

Non-Cash 174 16.8% Non-Cash 50 17.5%

Skimming 167 16.1% Cash on Hand 47 16.5%

Expense Reimbursements 164 15.8% Skimming 42 14.7%

Check Tampering 154 14.8% Cash Larceny 34 11.9%

Payroll 131 12.6% Check Tampering 33 11.6%

Cash on Hand 125 12.0% Expense Reimbursements 26 9.1%

Cash Larceny 102 9.8% Financial Statement Fraud 16 5.6%

Financial Statement Fraud 93 9.0% Payroll 11 3.9%

Register Disbursements 29 2.8% Register Disbursements 7 2.5%

8 For definitions of each of these sub-scheme types, please see the Glossary of Terminology on page 90.

9 For purposes of this report, the term check tampering includes manipulation of payments made via both paper-based checks and electronic payment methods.

14 REPORT TO THE NATIONS ON OCCUPATIONAL FRAUD AND ABUSE