Page 598 - ACFE Fraud Reports 2009_2020

P. 598

FRAUD IN SMALL BUSINESSES Corruption 32% 43%

29%

Billing 18%

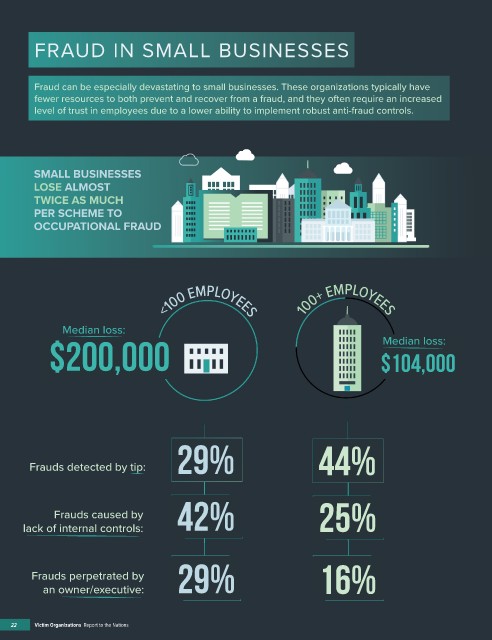

Fraud can be especially devastating to small businesses. These organizations typically have 22%

Check and

fewer resources to both prevent and recover from a fraud, and they often require an increased payment tampering 8%

level of trust in employees due to a lower ability to implement robust anti-fraud controls. Expense 21%

reimbursements 11%

Skimming 20% Small businesses face

8% DIFFERENT RISKS

20%

Cash on hand

14% than larger organizations

SMALL BUSINESSES Noncash 16% 22%

LOSE ALMOST Financial 16%

TWICE AS MUCH statement fraud 7%

PER SCHEME TO Cash larceny 9% 14%

OCCUPATIONAL FRAUD <100 Employees

Payroll 13%

5%

Register 3% 100+ Employees

disbursements 2%

0% 10% 20% 30% 40%

PERCENT OF CASES

<100 EMPLOYEES 100+ EMPLOYEES

Median loss: Median loss: Small businesses

$200,000 $104,000 typically have fewer 100%

anti-fraud Controls

than larger organizations,

leaving them more 80%

vulnerable to fraud

100+ Employees 60%

29% 44% 40%

Frauds detected by tip:

Frauds caused by 42% 25% <100 Employees 20%

lack of internal controls: Surprise audits Anti-fraud policy Internal audit department Management review 0%

Code of conduct

Employee support programs

Hotline

Management certification of financial statements

Formal fraud risk assessments

Job rotation/mandatory vacation

Rewards for whistleblowers

Proactive data monitoring/analysis

Fraud training for managers/executives

an owner/executive: 29% 16% External audit of internal controls over financial reporting

Frauds perpetrated by Dedicated fraud department, function, or team Fraud training for employees Independent audit committee External audit of financial statements

22 Victim Organizations Report to the Nations