Page 88 - ACFE Fraud Reports 2009_2020

P. 88

Table of Contents

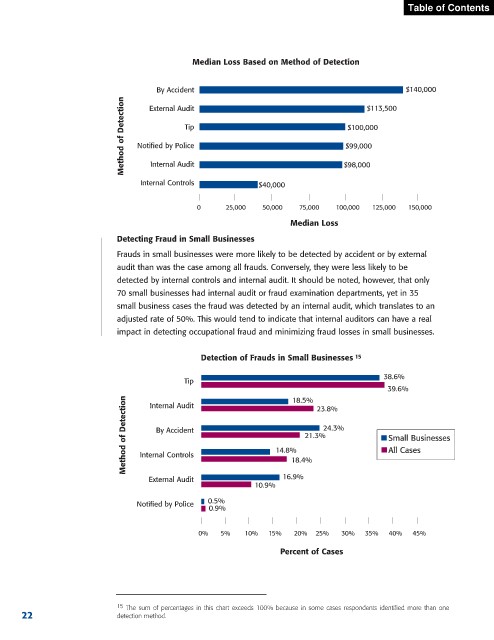

Median Loss Based on Method of Detection

By Accident $113,500 $140,000

Method of Detection Notified by Police $99,000

External Audit

Tip

$100,000

Internal Audit

Internal Controls $40,000 $98,000

0 25,000 50,000 75,000 100,000 125,000 150,000

Median Loss

Detecting Fraud in Small Businesses

Frauds in small businesses were more likely to be detected by accident or by external

audit than was the case among all frauds. Conversely, they were less likely to be

detected by internal controls and internal audit. It should be noted, however, that only

70 small businesses had internal audit or fraud examination departments, yet in 35

small business cases the fraud was detected by an internal audit, which translates to an

adjusted rate of 50%. This would tend to indicate that internal auditors can have a real

impact in detecting occupational fraud and minimizing fraud losses in small businesses.

Detection of Frauds in Small Businesses 15

38.6%

Tip

39.6%

Method of Detection Internal Controls 14.8% 21.3% 24.3% Small Businesses

18.5%

Internal Audit

23.8%

By Accident

All Cases

18.4%

External Audit 16.9%

10.9%

0.5%

Notified by Police

0.9%

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

Percent of Cases

15 The sum of percentages in this chart exceeds 100% because in some cases respondents identified more than one

22 detection method.