Page 161 - Adopt-a-School Foundation 2016-2017 Annual Report

P. 161

ADOPT-A-SCHOOL FOUNDATION NPC

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

for the year ended 30 June 2017

1.3 new standards and interpretations

In the current period, the Foundation has adopted the following standards and interpretations that are effective for the period ended 30 June 2017 and that

are relevant to its operations:

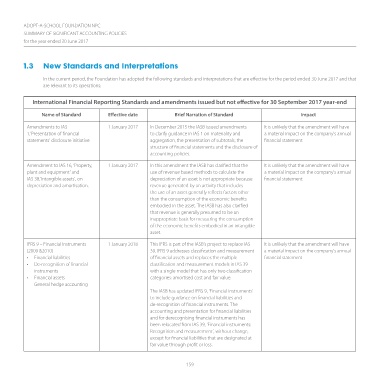

International Financial Reporting Standards and amendments issued but not effective for 30 September 2017 year-end

Name of Standard Effective date Brief Narration of Standard Impact

Amendments to IAS 1 January 2017 In December 2015 the IASB issued amendments It is unlikely that the amendment will have

1,’Presentation of financial to clarify guidance in IAS 1 on materiality and a material impact on the company’s annual

statements’ disclosure initiative aggregation, the presentation of subtotals, the financial statement

structure of financial statements and the disclosure of

accounting policies.

Amendment to IAS 16, ‘Property, 1 January 2017 In this amendment the IASB has clarified that the It is unlikely that the amendment will have

plant and equipment’ and use of revenue based methods to calculate the a material impact on the company’s annual

IAS 38,’Intangible assets’, on depreciation of an asset is not appropriate because financial statement

depreciation and amortisation. revenue generated by an activity that includes

the use of an asset generally reflects factors other

than the consumption of the economic benefits

embodied in the asset. The IASB has also clarified

that revenue is generally presumed to be an

inappropriate basis for measuring the consumption

of the economic benefits embodied in an intangible

asset.

IFRS 9 – Financial Instruments 1 January 2018 This IFRS is part of the IASB’s project to replace IAS It is unlikely that the amendment will have

(2009 &2010) 39. IFRS 9 addresses classification and measurement a material impact on the company’s annual

• Financial liabilities of financial assets and replaces the multiple financial statement

• De-recognition of financial classification and measurement models in IAS 39

instruments with a single model that has only two classification

• Financial assets categories: amortised cost and fair value.

General hedge accounting

The IASB has updated IFRS 9, ‘Financial instruments’

to include guidance on financial liabilities and

de-recognition of financial instruments. The

accounting and presentation for financial liabilities

and for derecognising financial instruments has

been relocated from IAS 39, ‘Financial instruments:

Recognition and measurement’, without change,

except for financial liabilities that are designated at

fair value through profit or loss.

159