Page 165 - Adopt-a-School Foundation 2016-2017 Annual Report

P. 165

ADOPT-A-SCHOOL FOUNDATION NPC

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

for the year ended 30 June 2017

1.6 financial Risk management (continued)

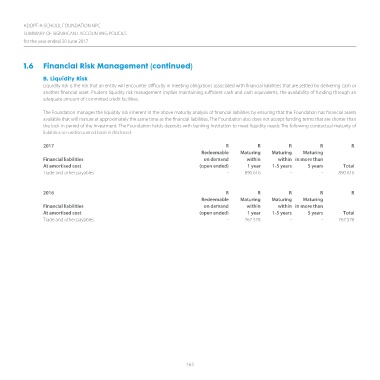

b. liquidity Risk

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities that are settled by delivering cash or

another financial asset. Prudent liquidity risk management implies maintaining sufficient cash and cash equivalents, the availability of funding through an

adequate amount of committed credit facilities.

The Foundation manages the liquidity risk inherent in the above maturity analysis of financial liabilities by ensuring that the Foundation has financial assets

available that will mature at approximately the same time as the financial liabilities. The Foundation also does not accept funding terms that are shorter than

the lock-in period of the investment. The Foundation holds deposits with banking institution to meet liquidity needs The following contractual maturity of

liabilities on undiscounted basis is disclosed:

2017 R R R R R

Redeemable Maturing Maturing Maturing

Financial liabilities on demand within within in more than

At amortised cost (open ended) 1 year 1-5 years 5 years Total

Trade and other payables - 890 616 - - 890 616

2016 R R R R R

Redeemable Maturing Maturing Maturing

Financial liabilities on demand within within in more than

At amortised cost (open ended) 1 year 1-5 years 5 years Total

Trade and other payables - 767 578 - - 767 578

163