Page 163 - Adopt-a-School Foundation 2016-2017 Annual Report

P. 163

ADOPT-A-SCHOOL FOUNDATION NPC

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

for the year ended 30 June 2017

1.4 significant Judgements and sources of estimation uncertainty

The Foundation determines residual values of property, plant and equipment at the end of each reporting period. A process of estimation is required to

estimate the residual value at year-end.

useful lives of property, plant and equipment

Useful lives are reviewed at the end of each reporting period. Management determines the useful lives of assets by taking into account the age of the asset,

the physical condition and the technological obsolescence.

estimation equity linked instruments

Detailed information about the estimates and judgements is included in note 3 together with information about the basis of calculation for the investment.

Residual values

The company determines residual values of property, plant and equipment at the end of each reporting period. A process of estimation is required to estimate

the residual value at year-end.

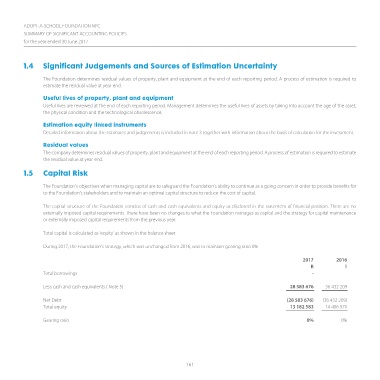

1.5 capital Risk

The Foundation’s objectives when managing capital are to safeguard the Foundation’s ability to continue as a going concern in order to provide benefits for

to the Foundation’s stakeholders and to maintain an optimal capital structure to reduce the cost of capital.

The capital structure of the Foundation consists of cash and cash equivalents and equity as disclosed in the statement of financial position. There are no

externally imposed capital requirements. There have been no changes to what the Foundation manages as capital and the strategy for capital maintenance

or externally imposed capital requirements from the previous year.

Total capital is calculated as ‘equity’ as shown in the balance sheet

During 2017, the Foundation’s strategy, which was unchanged from 2016, was to maintain gearing ratio 0%

2017 2016

R R

Total borrowings - -

Less cash and cash equivalents ( Note 5) 28 583 676 36 432 209

Net Debt (28 583 676) (36 432 209)

Total equity 13 182 583 14 406 970

Gearing ratio 0% 0%

161