Page 164 - Adopt-a-School Foundation 2016-2017 Annual Report

P. 164

ADOPT-A-SCHOOL FOUNDATION NPC

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

for the year ended 30 June 2017

1.6 financial Risk management

The Foundation’s activities expose it to a variety of financial risks: market risk (including currency risk, interest rate risk, and price risk), credit risk and liquidity

risk. The Foundation seeks to minimise potential adverse effects on financial performance of the Foundation. The Board provides principles for overall risk

management, interest rate risk, credit risk, and investing excess liquidity.

All investments for the Foundation are in line with the Adopt-a-School Foundation investment policy. The policy aims to manage investment risk and optimise

investment returns within manageable risk parameters.

The objectives of this investment policy are to ensure that:

• Funds are invested in prudent investments only.

• Achieve acceptable returns.

• Minimise risk to Adopt-a-School.

• Donors have comfort that funds are prudently invested to meet Adopt-A-School objectives.

• Adequate reporting.

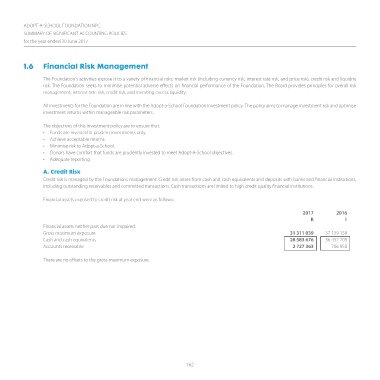

A. credit Risk

Credit risk is managed by the Foundations management. Credit risk arises from cash and cash equivalents and deposits with banks and financial institutions,

including outstanding receivables and committed transactions. Cash transactions are limited to high credit quality financial institutions.

Financial assets exposed to credit risk at year end were as follows:

2017 2016

R R

Financial assets neither past due nor impaired:

Gross maximum exposure 31 311 039 37 139 159

Cash and cash equivalents 28 583 676 36 432 209

Accounts receivable 2 727 363 706 950

There are no offsets to the gross maximum exposure.

162