Page 166 - Adopt-a-School Foundation 2016-2017 Annual Report

P. 166

ADOPT-A-SCHOOL FOUNDATION NPC

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

for the year ended 30 June 2017

1.6 financial Risk management (continued)

c. market Risk

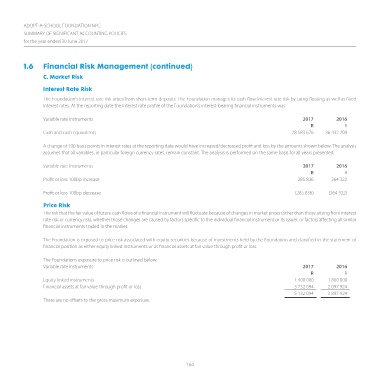

interest Rate Risk

The Foundation’s interest rate risk arises from short-term deposits. The Foundation manages its cash flow interest rate risk by using floating as well as fixed

interest rates. At the reporting date the interest rate profile of the Foundation’s interest-bearing financial instruments was

Variable rate Instruments 2017 2016

R R

Cash and cash equivalents 28 583 676 36 432 209

A change of 100 basis points in interest rates at the reporting date would have increased/decreased profit and loss by the amounts shown below. The analysis

assumes that all variables, in particular foreign currency rates, remain constant. The analysis is performed on the same basis for all years presented:

Variable rate Instruments 2017 2016

R R

Profit or loss 100bp increase 285 836 364 322

Profit or loss 100bp decrease (285 836) (364 322)

price Risk

The risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market prices (other than those arising from interest

rate risk or currency risk), whether those changes are caused by factors specific to the individual financial instrument or its issuer, or factors affecting all similar

financial instruments traded in the market.

The Foundation is exposed to price risk associated with equity securities because of investments held by the Foundation and classified in the statement of

financial position as either equity linked instruments or as financial assets at fair value through profit or loss.

The Foundations exposure to price risk is outlined below:

Variable rate Instruments 2017 2016

R R

Equity linked instruments 1 400 000 1 800 000

Financial assets at fair value through profit or loss 3 732 094 2 097 924

5 132 094 3 897 924

There are no offsets to the gross maximum exposure.

164