Page 115 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 115

Don’t Make Me Say I Told You So 101

matter of time before the company’s prospects improve, and

the stock price goes higher. If these stocks don’t rebound

quickly, stockholders get a nice oversized dividend yield while

they wait. When the stock price does rebound, investors get the

value appreciation in addition to the dividends. Because the

stock is beaten down in price relative to other stocks of its kind,

as determined by the larger dividend yield, the philosophy is

that there isn’t a lot of downside risk.

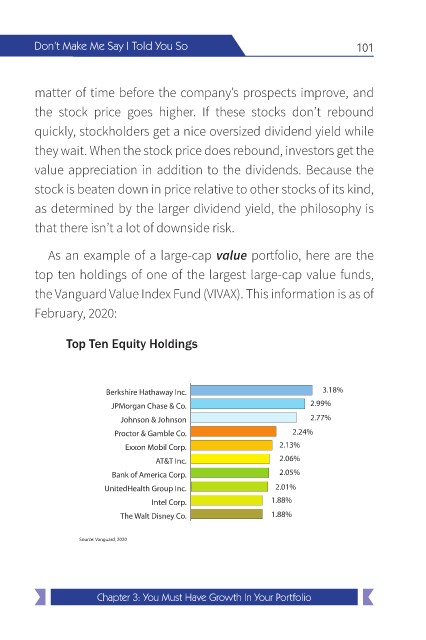

As an example of a large-cap value portfolio, here are the

top ten holdings of one of the largest large-cap value funds,

the Vanguard Value Index Fund (VIVAX). This information is as of

February, 2020:

Top Ten Equity Holdings

Berkshire Hathaway Inc. 3.18%

JPMorgan Chase & Co. 2.99%

Johnson & Johnson 2.77%

Proctor & Gamble Co. 2.24%

Exxon Mobil Corp. 2.13%

AT&T Inc. 2.06%

Bank of America Corp. 2.05%

UnitedHealth Group Inc. 2.01%

Intel Corp. 1.88%

The Walt Disney Co. 1.88%

Source: Vanguard, 2020

Chapter 3: You Must Have Growth In Your Portfolio