Page 120 - FlipBook BACK FROM SARAN - MAY 5 2020 - Don't Make Me Say I Told You So_6.14x9.21_v9_Neat

P. 120

106 Don’t Make Me Say I Told You So

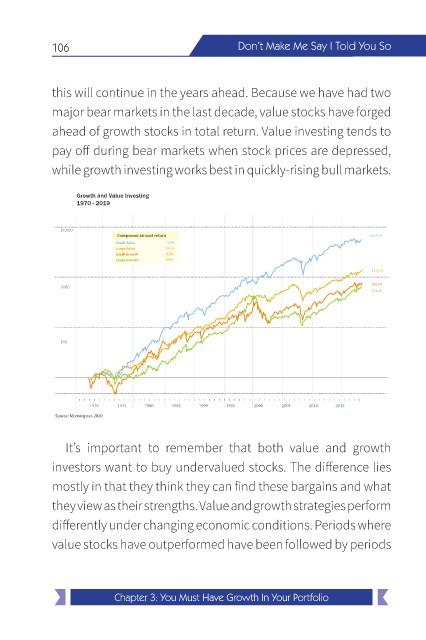

this will continue in the years ahead. Because we have had two

major bear markets in the last decade, value stocks have forged

ahead of growth stocks in total return. Value investing tends to

pay off during bear markets when stock prices are depressed,

while growth investing works best in quickly-rising bull markets.

Growth and Value Investing

1970 - 2019

$1,000

Compound annual return $667.08

Small Value 13.9%

Large Value 10.6%

Small Growth 9.3%

Large Growth 8.9%

$153.47

$86.06

$100

$72.21

$10

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

Source: Morningstar, 2020

It’s important to remember that both value and growth

investors want to buy undervalued stocks. The difference lies

mostly in that they think they can find these bargains and what

they view as their strengths. Value and growth strategies perform

differently under changing economic conditions. Periods where

value stocks have outperformed have been followed by periods

Chapter 3: You Must Have Growth In Your Portfolio