Page 57 - Ecobank Gambia Annual Report 2020

P. 57

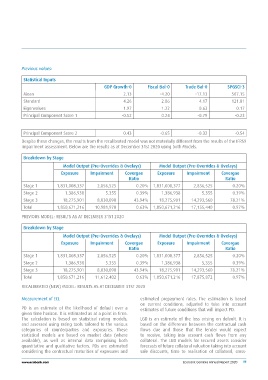

Previous values: GDP Growth-0 Fiscal Bal-0 Trade Bal-0 SPGSCI-3

2.13 -4.20 -17.13 507.15

Statistical Inputs 4.26 2.06 4.17 121.81

1.97 1.22 0.63 0.17

Mean -0.52 0.24 -0.79 -0.23

Standard

Eigenvalues

Principal Component Score 1

Principal Component Score 2 0.43 -0.65 -0.32 -0.54

Despite these changes, the results from the recalibrated model was not materially different from the results of the IFRS9

impairment assessment. Below are the results as at December 31st 2020 using both Models.

Breakdown by Stage

Model Output (Pre-Overrides & Ovelays) Model Output (Pre-Overrides & Ovelays)

Exposure Impairment Covergae Exposure Impairment Covergae

Ratio Ratio

Stage 1 1,831,008,337 2,856,525 0.20% 1,831,008,377 2,856,525 0.20%

Stage 2

Stage 3 1,386,938 5.355 0.39% 1,386,938 5,355 0.39%

Total

18,275,901 8,030,090 43.94% 18,275,901 14,293,560 78.21%

1,850,671,216 10,981,970 0.63% 1,850,671,216 17,155,440 0.97%

PREVIOUS MODEL: RESULTS AS AT DECEMBER 31ST 2020

Breakdown by Stage

Model Output (Pre-Overrides & Ovelays) Model Output (Pre-Overrides & Ovelays)

Exposure Impairment Covergae Exposure Impairment Covergae

Ratio Ratio

Stage 1 1,831,008,337 2,856,525 0.20% 1,831,008,377 2,856,525 0.20%

Stage 2

Stage 3 1,386,938 5.355 0.39% 1,386,938 5,355 0.39%

Total

18,275,901 8,030,090 43.94% 18,275,901 14,293,560 78.21%

1,850,671,216 11,612,402 0.63% 1,850,671,216 17,875,872 0.97%

RECALIBRATED (NEW) MODEL: RESULTS AS AT DECEMBER 31ST 2020

Measurement of ECL estimated prepayment rates. The estimation is based

PD is an estimate of the likelihood of default over a on current conditions, adjusted to take into account

given time horizon. It is estimated as at a point in time. estimates of future conditions that will impact PD.

The calculation is based on statistical rating models, LGD is an estimate of the loss arising on default. It is

and assessed using rating tools tailored to the various based on the difference between the contractual cash

categories of counterparties and exposures. These flows due and those that the lender would expect

statistical models are based on market data (where to receive, taking into account cash flows from any

available), as well as internal data comprising both collateral. The LGD models for secured assets consider

quantitative and qualitative factors. PDs are estimated forecasts of future collateral valuation taking into account

considering the contractual maturities of exposures and sale discounts, time to realisation of collateral, cross-

www.ecobank.com Ecobank Gambia Annual Report 2020 55