Page 39 - Manual - Well Fixed Assets and Barcode Asset Checking

P. 39

WELL - FIXED ASSET

2.4.1 Adjust the cost only, where DP values will all be calculated. For example, 1

asset has a 5-year depreciation period but its depreciation value has already been calculated for three

years. There are 2 years left and the repair expense will occur. It is required to revalue the repair

expense and the original cost, but the DP will be calculated for the next 2 years.

2.4.2 Overhaul the entire value. In this case, you may be allowed to adjust cost as

well as extend the DP period.

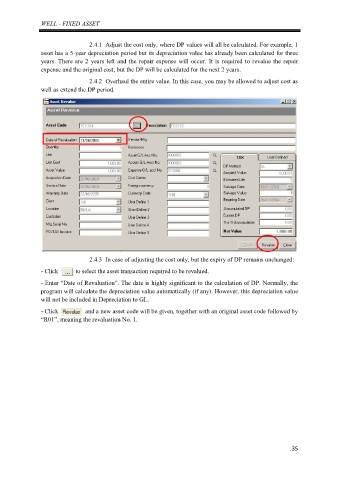

2.4.3 In case of adjusting the cost only, but the expiry of DP remains unchanged:

- Click to select the asset transaction required to be revalued.

- Enter “Date of Revaluation”. The date is highly significant to the calculation of DP. Normally, the

program will calculate the depreciation value automatically (if any). However, this depreciation value

will not be included in Depreciation to GL.

- Click and a new asset code will be given, together with an original asset code followed by

“R01”, meaning the revaluation No. 1.

35