Page 3 - MCC-2014-Booklet-Final

P. 3

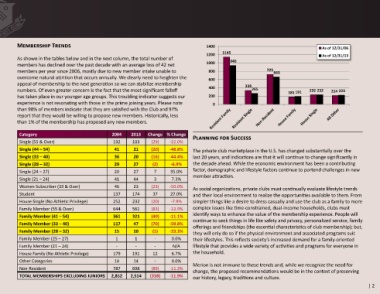

Membership Trends 1400 As of 12/31/06

1200 1145 As of 12/31/13

As shown in the tables below and in the next column, the total number of 940

members has declined over the past decade with an average loss of 42 net 1000

members per year since 2006, mostly due to new member intake unable to 800 725 663

overcome natural attrition that occurs annually. We clearly need to heighten the 600

appeal of membership to the next generation so we can stabilize membership 338

numbers. Of even greater concern is the fact that the most significant falloff 400 265 181 191 232 232 214 223

has taken place in our younger age groups. This troubling indicator suggests our 200

experience is not resonating with those in the prime joining years. Please note 0

than 98% of members indicate that they are satisfied with the Club and 97%

report that they would be willing to propose new members. Historically, less

than 1% of the membership has proposed any new members.

Category 2004 2013 Change % Change Planning for Success

Single (55 & Over) 132 103 (29) -22.0%

Single (44 – 54) 41 21 (20) -48.8% The private club marketplace in the U.S. has changed substantially over the

Single (33 – 40) 36 20 (16) -44.4% last 20 years, and indications are that it will continue to change significantly in

Single (28 – 32) 29 27 (2) -6.9% the decade ahead. While the economic environment has been a contributing

Single (24 – 27) 20 27 7 35.0% factor, demographic and lifestyle factors continue to portend challenges in new

Single (21 – 24) 41 44 3 7.3% member attraction.

Women Subscriber (33 & Over) 46 23 (23) -50.0% As social organizations, private clubs must continually evaluate lifestyle trends

Student 137 174 37 27.0% and their local environment to realize the opportunities available to them. From

House Single (No Athletic Privilege) 252 232 (20) -7.9% simpler things like a desire to dress casually and use the club as a family to more

Family Member (55 & Over) 644 561 (83) -12.9% complex issues like time-constrained, dual-income households, clubs must

Family Member (41 – 54) 361 321 (40) -11.1% identify ways to enhance the value of the membership experience. People will

Family Member (33 – 40) 117 47 (70) -59.8% continue to seek things in life like safety and privacy, personalized service, family

offerings and friendships (the essential characteristics of club membership); but,

Family Member (28 – 32) 15 10 (5) -33.3% they will only do so if the physical environment and associated programs suit

Family Member (25 – 27) 1 1 - 0.0% their lifestyles. This reflects society’s increased demand for a family-oriented

Family Member (21 – 24) - - - N/A lifestyle that provides a wide variety of activities and programs for everyone in

House Family (No Athletic Privilege) 179 191 12 6.7% the household.

Other Categories 14 14 - 0.0%

Non-Resident 787 698 (89) -11.3% Merion is not immune to these trends and, while we recognize the need for

change, the proposed recommendations would be in the context of preserving

TOTAL MEMBERSHIPS EXCLUDING JUNIORS 2,852 2,514 (338) -11.9% our history, legacy, traditions and culture.

| 2