Page 15 - NEW ICON GUIDE (PORTRAIT)

P. 15

Retirement Savings

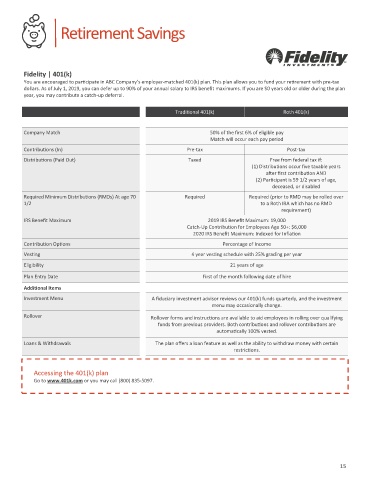

Fidelity | 401(k)

You are encouraged to participate in ABC Company’s employer-matched 401(k) plan. This plan allows you to fund your retirement with pre-tax

dollars. As of July 1, 2019, you can defer up to 90% of your annual salary to IRS benefit maximums. If you are 50 years old or older during the plan

year, you may contribute a catch-up deferral.

Traditional 401(k) Roth 401(k)

Company Match 50% of the first 6% of eligible pay

Match will occur each pay period

Contributions (In) Pre-tax Post-tax

Distributions (Paid Out) Taxed Free from federal tax if:

(1) Distributions occur five taxable years

after first contribution AND

(2) Participant is 59 1/2 years of age,

deceased, or disabled

Required Minimum Distributions (RMDs) At age 70 Required Required (prior to RMD may be rolled over

1/2 to a Roth IRA which has no RMD

requirement)

IRS Benefit Maximum 2019 IRS Benefit Maximum: 19,000

Catch-Up Contribution for Employees Age 50+: $6,000

2020 IRS Benefit Maximum: Indexed for Inflation

Contribution Options Percentage of Income

Vesting 4 year vesting schedule with 25% grading per year

Eligibility 21 years of age

Plan Entry Date First of the month following date of hire

Additional Items

Investment Menu A fiduciary investment advisor reviews our 401(k) funds quarterly, and the investment

menu may occasionally change.

Rollover Rollover forms and instructions are available to aid employees in rolling over qualifying

funds from previous providers. Both contributions and rollover contributions are

automatically 100% vested.

Loans & Withdrawals The plan offers a loan feature as well as the ability to withdraw money with certain

restrictions.

Accessing the 401(k) plan

Go to www.401k.com or you may call (800) 835-5097.

15