Page 7 - NEW ICON GUIDE (PORTRAIT)

P. 7

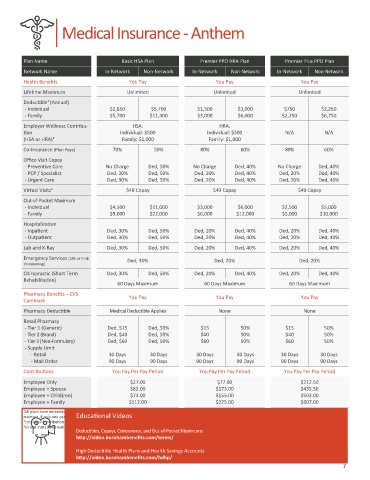

Medical Insurance - Anthem

Plan Name Basic HSA Plan Premier PPO HRA Plan Premier Plus PPO Plan

Network Name In-Network Non-Network In-Network Non-Network In-Network Non-Network

Health Benefits You Pay You Pay You Pay

Lifetime Maximum Unlimited Unlimited Unlimited

Deductible¹ (Annual)

- Individual $2,850 $5,700 $1,500 $3,000 $750 $2,250

- Family $5,700 $11,400 $3,000 $6,000 $2,250 $6,750

Employer Wellness Contribu- HSA: HRA:

tion Individual: $500 Individual: $500 N/A N/A

(HSA or HRA)² Family: $1,000 Family: $1,000

Co-Insurance (Plan Pays) 70% 50% 80% 60% 80% 60%

Office Visit Copay

- Preventive Care No Charge Ded, 50% No Charge Ded, 40% No Charge Ded, 40%

- PCP / Specialist Ded, 30% Ded, 50% Ded, 20% Ded, 40% Ded, 20% Ded, 40%

- Urgent Care Ded, 30% Ded, 50% Ded, 20% Ded, 40% Ded, 20% Ded, 40%

Virtual Visitsᶟ $49 Copay $49 Copay $49 Copay

Out-of-Pocket Maximum

- Individual $4,500 $11,000 $3,000 $6,000 $2,500 $5,000

- Family $9,000 $22,000 $6,000 $12,000 $5,000 $10,000

Hospitalization

- Inpatient Ded, 30% Ded, 50% Ded, 20% Ded, 40% Ded, 20% Ded, 40%

- Outpatient Ded, 30% Ded, 50% Ded, 20% Ded, 40% Ded, 20% Ded, 40%

Lab and X-Ray Ded, 30% Ded, 50% Ded, 20% Ded, 40% Ded, 20% Ded, 40%

Emergency Services (Life or limb Ded, 30% Ded, 20% Ded, 20%

threatening)

Chiropractic (Short Term Ded, 30% Ded, 50% Ded, 20% Ded, 40% Ded, 20% Ded, 40%

Rehabilitation)

60 Days Maximum 60 Days Maximum 60 Days Maximum

Pharmacy Benefits—CVS You Pay You Pay You Pay

Caremark

Pharmacy Deductible Medical Deductible Applies None None

Retail Pharmacy

- Tier 1 (Generic) Ded, $15 Ded, 50% $15 50% $15 50%

- Tier 2 (Brand) Ded, $40 Ded, 50% $40 50% $40 50%

- Tier 3 (Non-Formulary) Ded, $60 Ded, 50% $60 50% $60 50%

- Supply Limit

- Retail 30 Days 30 Days 30 Days 30 Days 30 Days 30 Days

- Mail Order 90 Days 90 Days 90 Days 90 Days 90 Days 90 Days

Contributions You Pay Per Pay Period You Pay Per Pay Period You Pay Per Pay Period

Employee Only $27.00 $77.00 $212.50

Employee + Spouse $82.00 $173.00 $435.50

Employee + Child(ren) $73.00 $155.00 $503.00

Employee + Family $112.00 $225.00 $607.00

¹All plans have embedded deductibles. When a family member meets his or her individual deductible, the insurance company will begin paying according to the plan’s coverage for that

Educational Videos

member. If only one person meets an individual deductible, the rest of the family still has to pay their deductibles.

²Employer Contribution to HSA or HRA is contingent upon completing the wellness program. Additional details can be found on page 6.

ᶟVirtual Visits (LiveHealth Online) is a $49 Copay until you reach your annual Deductible, and then you will pay your coinsurance until you meet your out of pocket maximum.

Deductibles, Copays, Coinsurance, and Out-of-Pocket Maximums

http://video.burnhambenefits.com/terms/

High Deductible Health Plans and Health Savings Accounts

http://video.burnhambenefits.com/hdhp/

7