Page 7 - Confie Benefits Guide 01-18_FINAL_r2_dp wording

P. 7

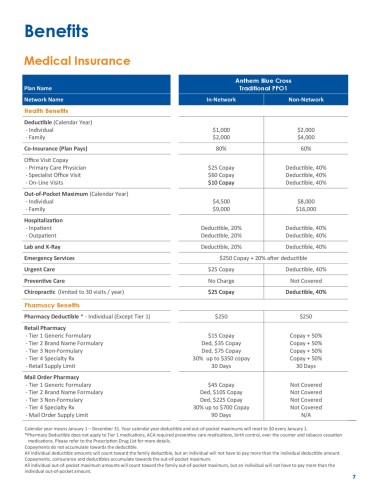

Benefits

Medical Insurance

Anthem Blue Cross

Plan Name Traditional PPO1

Network Name In-Network Non-Network

Health Benefits

Deductible (Calendar Year)

- Individual $1,000 $2,000

- Family $2,000 $4,000

Co-Insurance (Plan Pays) 80% 60%

Office Visit Copay

- Primary Care Physician $25 Copay Deductible, 40%

- Specialist Office Visit $60 Copay Deductible, 40%

- On-Line Visits $10 Copay Deductible, 40%

Out-of-Pocket Maximum (Calendar Year)

- Individual $4,500 $8,000

- Family $9,000 $16,000

Hospitalization

- Inpatient Deductible, 20% Deductible, 40%

- Outpatient Deductible, 20% Deductible, 40%

Lab and X-Ray Deductible, 20% Deductible, 40%

Emergency Services $250 Copay + 20% after deductible

Urgent Care $25 Copay Deductible, 40%

Preventive Care No Charge Not Covered

Chiropractic (limited to 30 visits / year) $25 Copay Deductible, 40%

Pharmacy Benefits

Pharmacy Deductible * - Individual (Except Tier 1) $250 $250

Retail Pharmacy

- Tier 1 Generic Formulary $15 Copay Copay + 50%

- Tier 2 Brand Name Formulary Ded, $35 Copay Copay + 50%

- Tier 3 Non-Formulary Ded, $75 Copay Copay + 50%

- Tier 4 Specialty Rx 30% up to $350 copay Copay + 50%

- Retail Supply Limit 30 Days 30 Days

Mail Order Pharmacy

- Tier 1 Generic Formulary $45 Copay Not Covered

- Tier 2 Brand Name Formulary Ded, $105 Copay Not Covered

- Tier 3 Non-Formulary Ded, $225 Copay Not Covered

- Tier 4 Specialty Rx 30% up to $700 Copay Not Covered

- Mail Order Supply Limit 90 Days N/A

Calendar year means January 1 – December 31. Your calendar year deductible and out-of-pocket maximums will reset to $0 every January 1.

*Pharmacy Deductible does not apply to Tier 1 medications, ACA required preventive care medications, birth control, over the counter and tobacco cessation

medications. Please refer to the Prescription Drug List for more details.

Copayments do not accumulate towards the deductible.

All individual deductible amounts will count toward the family deductible, but an individual will not have to pay more than the individual deductible amount.

Copayments, coinsurance and deductibles accumulate towards the out-of-pocket maximum.

All individual out-of-pocket maximum amounts will count toward the family out-of-pocket maximum, but an individual will not have to pay more than the

individual out-of-pocket amount.

7