Page 8 - Confie Benefits Guide 01-18_FINAL_r2_dp wording

P. 8

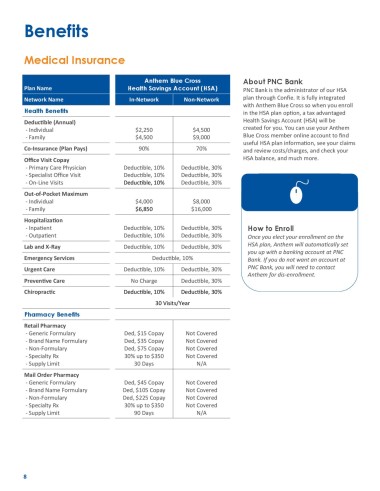

Benefits

Medical Insurance

Anthem Blue Cross About PNC Bank

Plan Name Health Savings Account (HSA) PNC Bank is the administrator of our HSA

Network Name In-Network Non-Network plan through Confie. It is fully integrated

with Anthem Blue Cross so when you enroll

Health Benefits in the HSA plan option, a tax advantaged

Deductible (Annual) Health Savings Account (HSA) will be

- Individual $2,250 $4,500 created for you. You can use your Anthem

- Family $4,500 $9,000 Blue Cross member online account to find

useful HSA plan information, see your claims

Co-Insurance (Plan Pays) 90% 70% and review costs/charges, and check your

Office Visit Copay HSA balance, and much more.

- Primary Care Physician Deductible, 10% Deductible, 30%

- Specialist Office Visit Deductible, 10% Deductible, 30%

- On-Line Visits Deductible, 10% Deductible, 30%

Out-of-Pocket Maximum

- Individual $4,000 $8,000

- Family $6,850 $16,000

Hospitalization

- Inpatient Deductible, 10% Deductible, 30% How to Enroll

- Outpatient Deductible, 10% Deductible, 30% Once you elect your enrollment on the

HSA plan, Anthem will automatically set

Lab and X-Ray Deductible, 10% Deductible, 30%

you up with a banking account at PNC

Emergency Services Deductible, 10% Bank. If you do not want an account at

Urgent Care Deductible, 10% Deductible, 30% PNC Bank, you will need to contact

Anthem for dis-enrollment.

Preventive Care No Charge Deductible, 30%

Chiropractic Deductible, 10% Deductible, 30%

30 Visits/Year

Pharmacy Benefits

Retail Pharmacy

- Generic Formulary Ded, $15 Copay Not Covered

- Brand Name Formulary Ded, $35 Copay Not Covered

- Non-Formulary Ded, $75 Copay Not Covered

- Specialty Rx 30% up to $350 Not Covered

- Supply Limit 30 Days N/A

Mail Order Pharmacy

- Generic Formulary Ded, $45 Copay Not Covered

- Brand Name Formulary Ded, $105 Copay Not Covered

- Non-Formulary Ded, $225 Copay Not Covered

- Specialty Rx 30% up to $350 Not Covered

- Supply Limit 90 Days N/A

8