Page 7 - The Raymond Group Supplemental Benefit Guide

P. 7

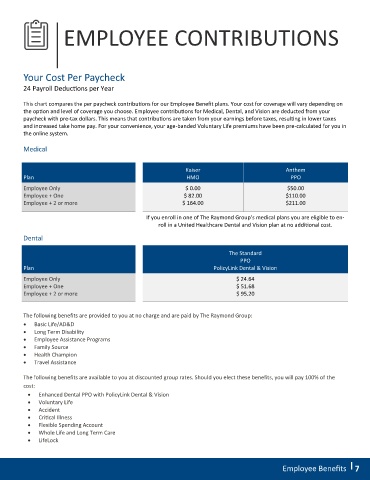

EMPLOYEE CONTRIBUTIONS

Your Cost Per Paycheck

24 Payroll Deductions per Year

This chart compares the per paycheck contributions for our Employee Benefit plans. Your cost for coverage will vary depending on

the option and level of coverage you choose. Employee contributions for Medical, Dental, and Vision are deducted from your

paycheck with pre-tax dollars. This means that contributions are taken from your earnings before taxes, resulting in lower taxes

and increased take home pay. For your convenience, your age-banded Voluntary Life premiums have been pre-calculated for you in

the online system.

Medical

Kaiser Anthem

Plan HMO PPO

Employee Only $ 0.00 $50.00

Employee + One $ 82.00 $110.00

Employee + 2 or more $ 164.00 $211.00

If you enroll in one of The Raymond Group’s medical plans you are eligible to en-

roll in a United Healthcare Dental and Vision plan at no additional cost.

Dental

The Standard

PPO

Plan PolicyLink Dental & Vision

Employee Only $ 24.64

Employee + One $ 51.68

Employee + 2 or more $ 95.20

The following benefits are provided to you at no charge and are paid by The Raymond Group:

• Basic Life/AD&D

• Long Term Disability

• Employee Assistance Programs

• Family Source

• Health Champion

• Travel Assistance

The following benefits are available to you at discounted group rates. Should you elect these benefits, you will pay 100% of the

cost:

• Enhanced Dental PPO with PolicyLink Dental & Vision

• Voluntary Life

• Accident

• Critical Illness

• Flexible Spending Account

• Whole Life and Long Term Care

• LifeLock

Employee Benefits 7