Page 121 - inside page.cdr

P. 121

ANNUAL REPORT 2018 - 2019

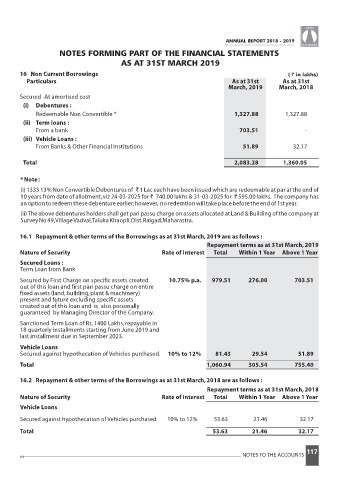

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

AS AT 31ST MARCH 2019

16 Non Current Borrowings ( ` in lakhs)

Particulars As at 31st As at 31st

March, 201 9 March, 201 8

Secured -At amortised cost

(i) Debentures :

Redeemable Non Convertible * 1,327.88 1,327.88

(ii) Term loans :

From a bank 703.51 -

(iii) Vehicle Loans :

From Banks & Other Financial Institutions 51.89 32.17

Total 2,083.28 1,360.05

*Note:

(i) 1335 13% Non Convertible Debentures of ` 1 Lac each have been issued which are redeemable at par at the end of

10 years from date of allotment,viz 24-03-2025 for ` 740.00 lakhs & 31-03-2025 for ` 595.00 lakhs. The company has

anoptiontoredeemthesedebentureearlier;however, noredemtionwilltakeplacebeforetheendof1styear.

(ii)The above debentures holders shall get pari passu charge on assets allocated at Land & Building of the company at

SurveyNo49,VillageVadval,TalukaKhaopli,Dist.Raigad,Maharastra.

16.1 Repayment & other terms of the Borrowings as at 31st March,201 are9 as follows :

Repayment terms as at 31st March,2019

Nature of Security Rate of Interest Total Within 1 Year Above 1 Year

Secured Loans :

Term Loan from Bank

Secured by First Charge on specific assets created 10.75% p.a. 979.51 276.00 703.51

out of this loan and first pari passu charge on entire

fixed assets (land,building,plant & machinery)

present and future excluding specific assets

created out of this loan and is also personally

guaranteed by Managing Director of the Company.

Sanctioned Term Loan of Rs.1400 Lakhs,repayable in

18 quarterly installments starting from June 2019 and

last installment due in September 2023.

Vehicle Loans

Secured against hypothecation of Vehicles purchased. 10% to 12% 81.43 29.54 51.89

Total 1,060.94 305.54 755.40

16.2 Repayment & other terms of the Borrowings as at 31st March,2018 are as follows :

Repayment terms as at 31st March,2018

Nature of Security Rate of Interest Total Within 1 Year Above 1 Year

Vehicle Loans

Secured against hypothecation of Vehicles purchased 10% to 12% 53.63 21.46 32.17

Total 53.63 21.46 32.17

117

NOTES TO THE ACCOUNTS