Page 122 - inside page.cdr

P. 122

AMINES & PLASTICIZERS LTD

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

AS AT 31ST MARCH 2019

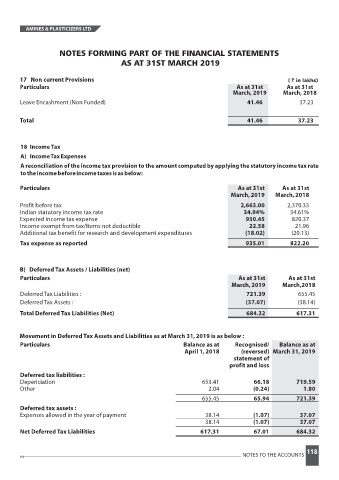

17 Non current Provisions ( ` in lakhs)

Particulars As at 31st As at 1st3

March, 201 9 March, 201 8

Leave Encashment (Non Funded) 41.46 37.23

Total 41.46 37.23

18 Income Tax

A) IncomeTaxExpenses

A reconciliation of the income tax provision to the amount computed by applying the statutory income tax rate

totheincomebeforeincometaxesisasbelow:

Particulars As at 31st As at 31st

March,201 9 March,201 8

Profit before tax 2,663.00 2,370.33

Indian statutory income tax rate 34.94% 34.61%

Expected income tax expense 930.45 820.37

Income exempt from tax/Items not deductible 22.58 21.96

Additional tax benefit for research and development expenditures (18.02) (20.13)

Tax expense as reported 935.01 822.20

B) Deferred Tax Assets / Liabilities (net)

Particulars As at 31st As at 1st3

March,201 9 March,201 8

Deferred Tax Liabilities : 721.39 655.45

Deferred Tax Assets : (37.07) (38.14)

Total Deferred Tax Liabilities (Net) 684.32 617.31

Movement in Deferred Tax Assets and Liabilities as at March 31,201 is as below :9

Particulars Balance as at Recognised/ Balance as at

April 1,201 8 (reversed) March 31, 201 9

statement of

profit and loss

Deferred tax liabilities :

Depericiation 653.41 66.18 719.59

Other 2.04 (0.24) 1.80

655.45 65.94 721.39

Deferred tax assets :

Expenses allowed in the year of payment 38.14 (1.07) 37.07

38.14 (1.07) 37.07

Net Deferred Tax Liabilities 617.31 67.01 684.32

118

NOTES TO THE ACCOUNTS