Page 71 - inside page.cdr

P. 71

ANNUAL REPORT 2018 - 2019

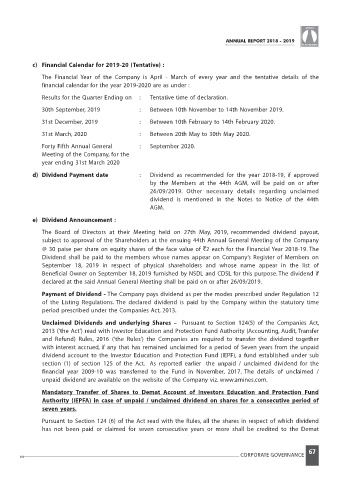

c) Financial Calendar for 2019-20 (Tentative) :

The Financial Year of the Company is April - March of every year and the tentative details of the

financial calendar for the year 2019-2020 are as under :

Results for the Quarter Ending on : Tentative time of declaration.

30th September, 2019 : Between 10th November to 14th November 2019.

31st December, 2019 : Between 10th February to 14th February 2020.

31st March, 2020 : Between 2 th May to 30th May 2020.0

Forty Fifth Annual General : September 2020.

Meeting of the Company, for the

year ending 31st March 2020

d) Dividend Payment date : Dividend as recommended for the year 2018-19, if approved

by the Members at the 44th AGM, will be paid on or after

26/09/2019. Other necessary details regarding unclaimed

dividend is mentioned in the Notes to Notice of the 44th

AGM.

e) Dividend Announcement :

The Board of Directors at their Meeting held on 27th May, 2019, recommended dividend payout,

subject to approval of the Shareholders at the ensuing 44th Annual General Meeting of the Company

@ 30 paise per share on equity shares of the face value of 2 each for the Financial Year 2018-19. The`

Dividend shall be paid to the members whose names appear on Company’s Register of Members on

September 1 , 2019 in respect of physical shareholders and whose name appear in the list of8

Beneficial Owner on September 1 , 2019 furnished by NSDL and CDSL for this purpose. The dividend if8

declared at the said Annual General Meeting shall be paid on or after 26/09/2019.

Payment of Dividend - The Company pays dividend as per the modes prescribed under Regulation 12

of the Listing Regulations. The declared dividend is paid by the Company within the statutory time

period prescribed under the Companies Act, 2013.

Unclaimed Dividends and underlying Shares – Pursuant to Section 124(5) of the Companies Act,

2013 (‘the Act’) read with Investor Education and Protection Fund Authority (Accounting, Audit, Transfer

and Refund) R ule , 2016 (‘the Rules’) the Companies are required to transfer the dividend togethers

with interest accrued, if any that has remained unclaimed for a period of Seven years from the unpaid

dividend account to the Investor Education and Protection Fund (IEPF), a fund established under sub

section (1) of section 125 of the Act. As reported earlier the unpaid / unclaimed dividend for the

financial year 2009-10 was transferred to the Fund in November, 2017. The details of unclaimed /

unpaid dividend are available on the website of the Company viz. www.amines.com.

Mandatory Transfer of Shares to Demat Account of Investors Education and Protection Fund

Authority (IEPFA) in case of unpaid / unclaimed dividend on shares for a consecutive period of

seven years.

Pursuant to Section 124 (6) of the Act read with the Rules, all the shares in respect of which dividend

has not been paid or claimed for seven consecutive years or more shall be credited to the Demat

67

CORPORATE GOVERNANCE