Page 19 - EmployeeOrientation_8-22-17_PRISMA_Neat

P. 19

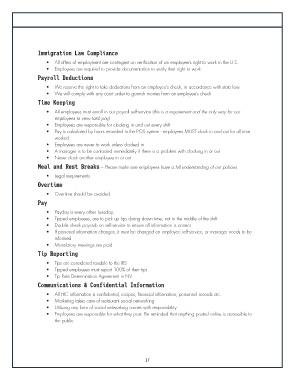

Immigration Law Compliance

• All offers of employment are contingent on verification of an employee’s right to work in the U .S .

• Employees are required to provide documentation to verify their right to work

Payroll Deductions

• We reserve the right to take deductions from an employee’s check, in accordance with state law

• We will comply with any court order to garnish monies from an employee’s check

Time Keeping

• All employees must enroll in our payroll self-service (this is a requirement and the only way for our

employees to view total pay)

• Employees are responsible for clocking in and out every shift

• Pay is calculated by hours recorded in the POS system - employees MUST clock in and out for all time

worked

• Employees are never to work unless clocked in

• A manager is to be contacted immediately if there is a problem with clocking in or out

• Never clock another employee in or out

Meal and Rest Breaks – Please make sure employees have a full understanding of our policies

• Legal requirements

Overtime

• Overtime should be avoided

Pay

• Payday is every other Tuesday .

• Tipped employees, are to pick up tips during down time, not in the middle of the shift

• Double check paystub on self-service to ensure all information is correct

• If personal information changes, it must be changed on employee self-service, or manager needs to be

informed

• Mandatory meetings are paid

Tip Reporting

• Tips are considered taxable to the IRS

• Tipped employees must report 100% of their tips

• Tip Rate Determination Agreement in NV

Communications & Confidential Information

• All FRC information is confidential, recipes, financial information, personnel records etc .

• Marketing takes care of restaurant social networking

• Utilizing any form of social networking comes with responsibility

• Employees are responsible for what they post . Be reminded that anything posted online is accessible to

the public

17

17 Revised February 2014